Q3 2020 Open Banking API Trends Datapoint: Global platforms

4 min read

Share this article

Last updated: 19 November 2020

Open Banking Platforms, Q3 2020

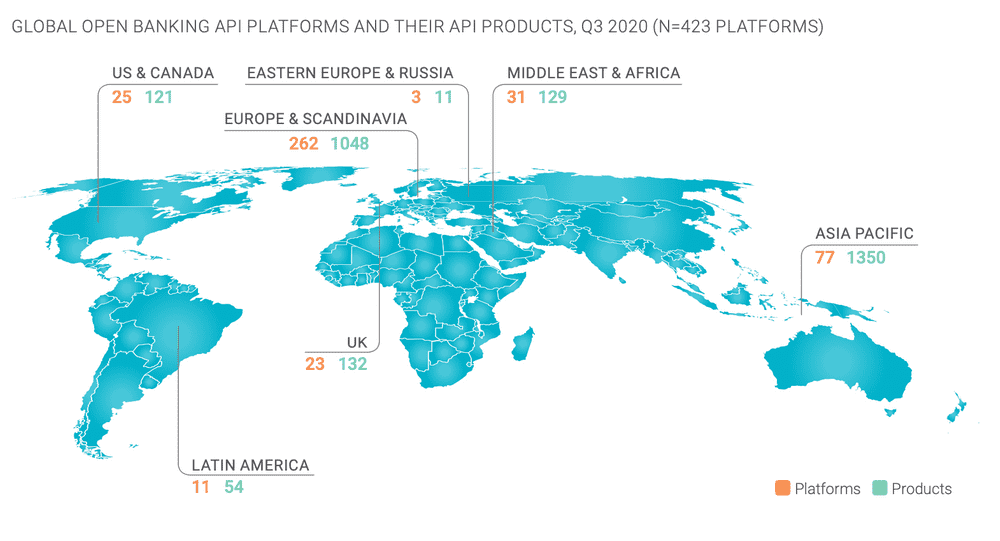

As at the end of the third quarter (September 2020), we counted 423 open banking platforms globally, together releasing 2,845 API products.

Open banking is growing in ubiquity globally and is now reaching a tipping point where forward-thinking banks will need to provide APIs in order to attract business customers who want to build their own platform offerings, and to keep individual/household consumers who want to be able to integrate their bank accounts with the latest fintech services.

Open Banking API Products, Q3 2020

The bulk of API products available from banks at present are to enable payments integrations and to review account balances. In Europe, UK, Australia, New Zealand, Singapore, and some other countries, banks are required (or soon will be) to offer APIs for these functionalities.

In UK and Australia, banks must also have a product catalogue available via API which is why these are also a common type of API provided. (They are also low risk for banks to test the waters as they do not expose any customer information or bank security information. The downside is that there are limited use cases where you can create useful value with a product catalogue or with ATM and branch locations... kind of. If banks offered detailed information in their product catalogue APIs by including up-to-date interest rates, fee structures, etc, they could be at least used in price comparison tools or could be woven into other recommendation software, perhaps even making bank account switching to the one with the best terms more seamless. But mostly banks don't make that level of information available in their bank product catalogues for fear of encouraging account switching amongst their customers!)

The growth of identity, credit scoring and loan pre-approvals, and (to a lesser extent) some of the other product categories does suggest that some banks are starting to think more creatively around what sort of new business models they could encourage by making modularised banking services available as composable APIs to (accredited, reliable, and secure) third parties.

So far, we are not seeing COVID-19 impact on the product category types or significantly increase the pace of new types of product APIs being made available from banks.

Three bank leaders opening APIs

To dig into more of the trends in open banking for Q3 2020 and for the past few years, see Platformable's Open Banking APIs State of the Market 2020 Report, sponsored by Axway: https://resources.axway.com/financial-services/report-open-banking-in-an-age-of-transformation