Open Banking Trends Q2 2020: Consumers

13 min read

Share this article

To date, there are some initial signs that open banking is creating greater choice for small and medium enterprise (SME) consumers and there are some isolated examples of fintech that use open banking APIs to create additional savings and generate wealth for individuals and households, but this is not a widespread impact from open banking as yet.

At Platformable, we categorise three main consumer categories:

- Individuals/households

- Small and Medium enterprises (SMEs)

- Enterprises.

For SME sub-categories, we use the European Commission definitions:

| Category | Definition |

|---|---|

| Sole traders/proprietors, Freelancers, Self-employed | With employees less than 10, revenue less than EUR 2 million |

| Small | With number of employees less than 50, revenue less than EUR 10 million |

| Medium | With number of employees less than 250, revenue less than EUR 50 million |

In Q2, we analysed products being created by accredited fintech in Europe, UK, Singapore, New Zealand, Hong Kong and Bahrain. These jurisdictions each have registers of certified fintech that are approved to use bank APIs. In future editions of our quarterly trends, we will also look at fintech using open banking APIs in markets without a regulated register of providers.

We are also looking at how best to measure the types of products that fintech are making available. There is no standardised, official taxonomy of fintech services being provided in the open banking ecosystem. We are currently creating a taxonomy that matches some of the most commonly used categorisations globally and matching these categories with those identified in emerging open finance regulations. A key goal for us will be to ensure we can categorise fintech products using the UK’s OBIE Consumer Report model that maps the benefits that consumers should receive from open banking, as shown in the diagram below:

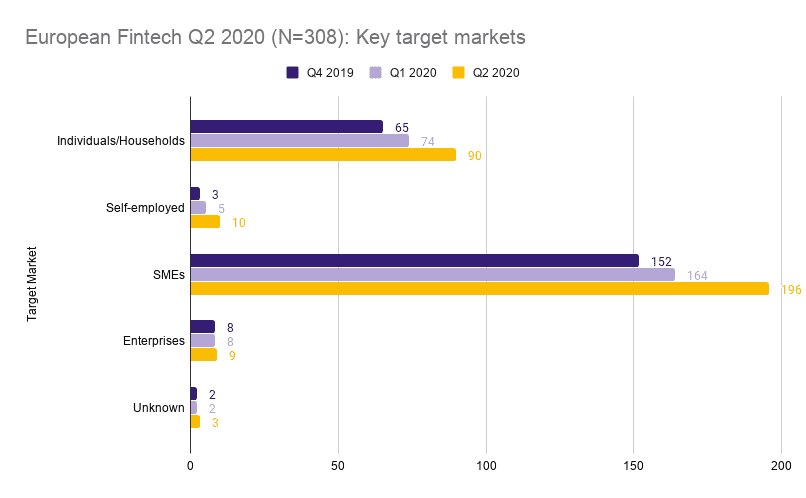

Target markets for European fintech in Q2 2020 (N=308)

Out of the 308 registered fintech in Europe building products and services with bank APIs, the majority (67%) are focused on creating value for SMEs . (For now, our model looks at the primary product being created by each fintech rather than all of the products being made available using bank APIs.)

This pattern is also evident in Asia-Pacific, where 90% of all primary products created by accredited fintech target SME consumers.

There are several reasons we believe that SMEs are the main focus of fintech to date:

- Fintech products targeting SMEs are likely to face less regulatory and compliance requirements in individual jurisdictions.

- Fintech can also price their products higher, and thus sell lower volume at higher profit margins to become a viable commercial offering.

- There is also generally a greater appetite amongst SMEs to use digital financial services from non-bank providers, and we posit that once they have made their choice and integrated the fintech product with their systems, they are more likely to maintain their relationship rather than switch products.

- Targeting SMEs is also a useful mid-term ground for fintech that want to test and refine their products before they go after the more lucrative enterprise market.

Individuals/Households

In Europe amongst accredited fintech using open banking APIs, 29% are targeted at individuals/households. This drops to 10% in Asia-Pacific. There are some examples where individuals and households are beginning to improve financial health from using fintech products built with open banking APIs. In our Q1 report, we described Cake, an app that shares revenue with their users by selling aggregated, anonymised data (see our spotlight below for more discussion on Cake’s model).

This quarter, we highlight three more fintech demonstrating benefits for individuals/households. Two of these offerings do not provide their products direct to consumers, but instead offer their products to banks, so that the banks can leverage digital tech to enhance their customers’ financial health.

- White-labeled subscription management service for banks

- Based on data that shows 35% of consumers would like their bank to offer a subscription management tool and that consumers spend 562 Euro annually on subscriptions they did not want

- One user said: “The first time I saw the feature in my bank app I was so surprised to see all my subscriptions at once that I immediately cancelled three of them. That was really cool. Especially when you like me have a lot of subscriptions that you’ve forgotten all about.”

- Accredited in 4 European countries

- Bank APIs used: Arbejdnernes Landsbank, Spar Nord, Sparebankenvest, Nordea, Lunar

- While Enfuce’s services are focused on the SME market, we found their new product, My Carbon Action, an interesting offering.

- This app is available to banks to offer their customers so that consumers can track the CO2 emission of all of their purchases.

- Consumers also receive smart tips to reduce carbon emissions based on both their personalised lifestyle and purchase habits.

- At present, Enfuce is only accredited to operate in 2 countries in Europe.

- Bank APIs used: Unclear but focused on Finland and Sweden

- Mobile money wallet for use in Singapore, Thailand, Japan

- Allows international payment transfers without additional transaction fees

- Has created a loyalty scheme for generating redeemable points for purchases made using the mobile money wallet

- Builds partnerships with brands that then offer discounts to users

- Bank APIs used: OCBC

Spotlight on individual/household fintech: Cake

Cake currently operates in Belgium but has accreditation across 5 European countries at present, and plans to expand in the near future into new markets. We listed the Cake app in our Q1 trends report as this is a promising example of the potential benefits to consumers from open banking. Cake offers a personal financial management (PFM) app that connects via open banking integrations to the app user’s bank account. Cake then provides the user with insights into their spending habits and commercialises the anonymised, aggregated data on spending habits of all their app users. They also work with specific retailers to offer their app users discounts, cashbacks, and loyalty schemes (which according to some studies increases consumer click-through rates from 7.6% to 25%, a value proposition that may recruit the retail partners Cake wants to onboard).

Cake’s model is particularly interesting because it moves beyond a theoretical model of assuming that consumers will improve their financial health by having greater insights into their spending patterns. In 2015, 66% of PFM users said their budget apps “helped them see how they can improve financially” and 4% said they save more money. That may be the case for Cake as well, and app users may also benefit from some savings by purchasing with the discounts provided through Cake’s retail partnerships. But what is fascinating and proves the real consumer value of open banking is that Cake has a data revenue-sharing model in place. In this model, 50% of the revenue generated by Cake when enterprise clients buy aggregated data is shared back with the app users. (We at Platformable love this model because it also helps encourage consumers to understand the value of their data and could help improve data literacy. Over time, this will hopefully lead consumers to demand more in return for the data that is collected about them on other platforms and from open banking more generally.)

Cofounder and Head of Legal & Operations at Cake, Yves Bovin, explained that enterprises are looking for consumer spending behavior data to help them with their product strategy or even their Go To Market (GTM) strategies. He gives an example of a store who currently provides office and paper products.. “They find it interesting to see to which stores their customers go in the hours before or after they go to the enterprise’s stores, so they can broaden their product range and enter new markets,” Bovin outlined.

“Since March this year, our return to our app users has increased to 9 Euro per quarter per user. We aim to give all of our app users 2-3 Euro each month for sharing their transaction data, and they can get more if they use our cashbacks offers as well,” said Bovin.

In Belgium, where Cake has started, the biggest challenge to date is the quality of the APIs the banks are offering and the resistance that banks are creating in terms of additional obstacles for fintech. The European Banking Authority’s 4 June Report “Opinion on obstacles to the provision of third party provider services (TPPs) under the Regulatory Technical Standards (RTS) on strong customer authentication (SCA) and common and secure communication (CSC)” reflects many of the issues facing third party providers in Belgium and across Europe. This has led the fintech advocacy association PayBelgium to prepare individual reports matching EBA’s list of obstacles to each bank in Belgium, with several banks looking fairly recalcitrant in terms of willingness to address the obstacles identified by the EBA. Does this demonstrate that banks aren’t that interested in ensuring open banking creates value for their customers? Do they not care about enhancing consumer financial health through open banking?

Unfortunately, it is not just the banks that are acting poorly in this context. The EBA’s report may be fairly toothless: they state it is now up to competent authorities in each European member state to establish monitoring and oversight that can address the obstacles identified in their report to ensure consumers are getting the expected value from open banking. It is unclear what progress is being made by each member state to review the report and implement this oversight. And the report from EBA itself is fairly complicated reading. There are no plain language interpretations available to help consumers (or consumer advocacy organisations) to understand what they should expect from open banking. The Obstacles report does not provide guidance to consumers on how they can report any breaches that they experience when they try to adopt apps to guide them in their financial future.

To date, these challenges have not stopped Cake. They are next eyeing the Netherlands, which is seen as having a much smoother open banking API landscape than Belgium. But at the end of the day, it is the size of a fintech’s app user base and a robust revenue model that may be the best defence for fintech entering the open banking market. And sharing in the €62,648.07 that app users have received to date may be the drawcard that consumers are looking for from their fintech.

Sole traders, freelancers, small and medium-sized businesses

In Europe, 67% of accredited fintech providers focus on the SME market. The top 3 product categories in Q2 2020 were:

- Collaborations and Workflow Software (49 products)

- Accounting and Invoice Software (45 products)

- Payment back-end and infrastructure (43 products).

In Asia-Pacific, 90% of accredited fintech focus on the SME market. These numbers are somewhat skewed by Singapore’s accreditation system which focuses on payments providers, although looking at one of the newest regulatory environments, New Zealand, the bulk of new accredited fintech entering the market are SME-focused.

- Finnish fintech accredited in 30 countries, currently operating in 8 countries

- Provides SME and sole trader business services directly linked to consumer’s bank account

- Focused on offering invoices, book-keeping and tax preparation

- Currently has 200,000 customers

- Expanding to UK

- Acquired by BBVA in 2016 but still operates as independent fintech

- Bank APIs used: Unclear from website

- UK-based fintech focused on flat-rate, low commission payments

- Currently integrated with UK banks but has accreditation for 31 countries across Europe

- Provides access to payments via API

- Has affiliation with Avios rewards so that Banked users can offer their customers a loyalty scheme

- Integrates with accounting software

- Allows subscriber payment agreements and electronic invoices with direct payment integrated

- Small community at present but used

- Bank APIs used: 18 UK banks linked at present

Spotlight on SME fintech: FriendlyScore

Imagine a small business that opened in early 2019. They have been operating for just over a year now. At one point, they reorganised their bank accounts and made a mistake: they ended up late on a credit card payment and only became aware of it when the bank reached out. Now, with COVID-19, they have an opportunity to lock in some of their current customers for the next six months, but to make the commitment they need to buy new laptops for all of their now-remote staff. They seek a loan, but despite their business account showing well-managed expenses, the missed credit card payment and their startup status means the bank rejects their application.

But predictive algorithms combined with new open banking models are now disrupting that disappointing experience for many small and medium enterprises (SMEs). By using open banking with predictive algorithms, a whole suite of new products are being made available, including new approaches to credit assessment.

One of the most advanced fintech offering real time credit assessment is FriendlyScore, operating out of the UK and Poland and currently live in the UK and Ireland markets (and, with accreditation in 31 European markets, plans to expand across all of Europe). The SME consumer approves FriendlyScore to connect with their bank account. FriendlyScore then uses that bank’s API to feed the customer’s transaction data into their algorithms. “We start with a transaction categorisation process,” Francis Darby, Chief Data Scientist at FriendlyScore said. “Data is still very raw for debit card transactions. Typically, it just describes the expense amount, date, and where the money was spent. We have an algorithm that uses natural language processing and our models behind the scenes categorise expenses into a predefined taxonomy that we developed.” (Another of the EBA identified obstacles to third party providers is that banks also share less of this data than they have access to themselves, in some cases stripping away up to 40% of the data that is needed to categorise the transaction.)

With this more granular detail on expense categorisation, FriendlyScore can then run the customer’s account through some predictive modeling and generate a financial liability score (measuring the likelihood that the business will miss a payment), and an affordability score (measuring the likelihood that the business will run out of cash in the near future). These can then be used in loans assessment and approvals processes by lenders.

In existing banking and credit scoring systems, these two processes are incredibly complex, manual, and slow: credit bureaus which often maintain credit scores of citizens typically have a one-month lag time and can take upwards of a year to update a missed credit payment, even if it is not the customer’s fault (like in our SME example). SMEs and startups are two of the segments most impacted by traditional credit scoring systems and are locked out of financial services that can help them with their cash flow.

AI-based credit assessment has greater accuracy in reviewing SME cash flow and business resilience, but beyond that “there is a blue ocean of use cases,” says Loubna Bazine, CEO at FriendlyScore. “Insurance companies are reaching out to use our predictive models to assess the insolvency of companies. There are opportunities to work with banks to support their customers who may be taking a payments holiday from their loans. And in cases where there are problems for the borrower (like recent unemployment), our tool can pick that up immediately so the lender can propose a new deal.”

In areas where banks have shown a conservatism that has locked out some SME customers, like in credit assessments and approvals, fintech can step in and offer a more diverse, nuanced range of products. In challenging times like COVID-19, an extended cashflow can make a significant difference to the viability and sustainability of an SME. FriendlyScore is proving predictive algorithms coupled with open banking can provide greater choice and improve SME financial health.