Q2 2022 Open Banking Trends: Regulators worldwide move toward open finance and beyond

5 min read

Share this article

The role of regulators

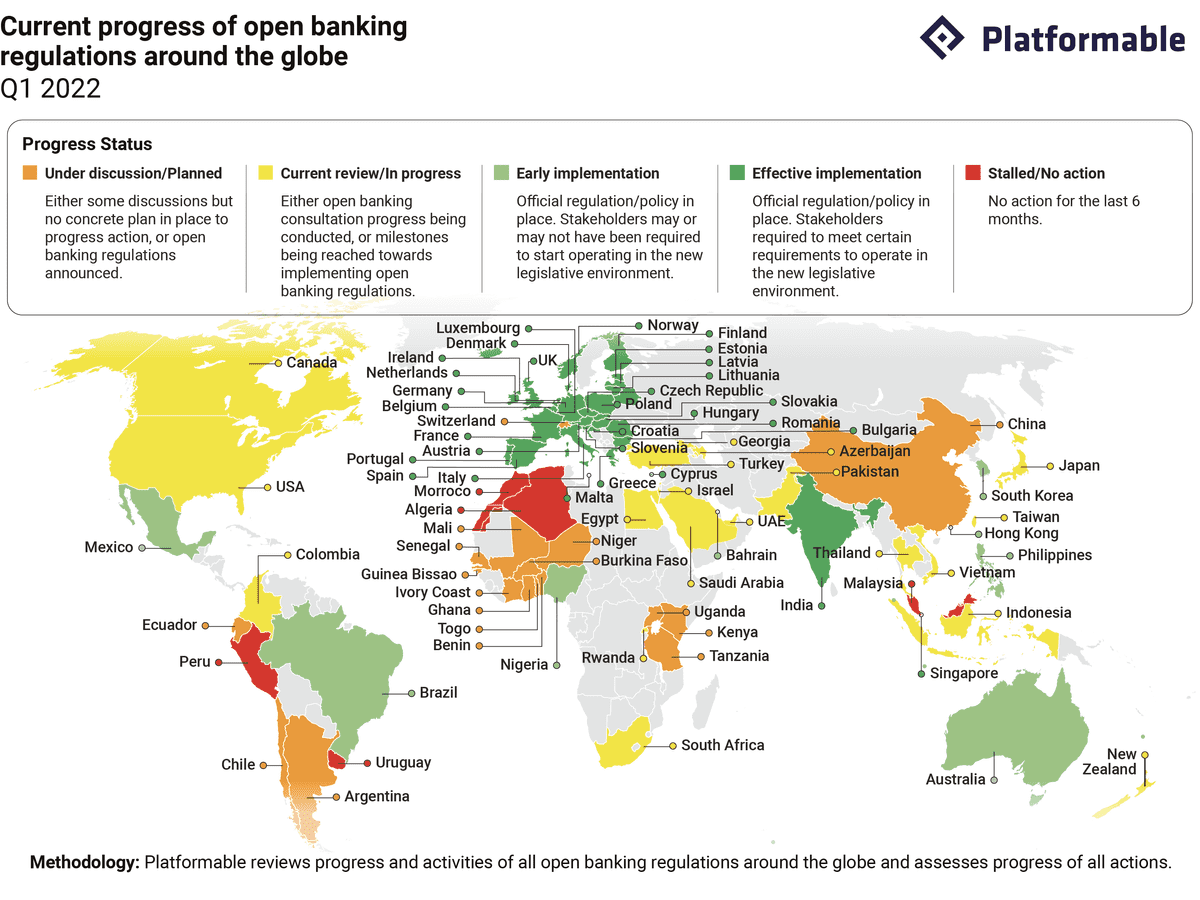

Our open banking/open finance ecosystem maps how APIs assist in generating new products and increasing financial health for end users. These API-based improvements also indirectly benefit society, local economies and the environment. In the open ecosystem, governments direct regulators to expand digital financial services infrastructure through open banking and open finance (in some locations, markets themselves encourage more significant action). By the end of Q2 2022, we identified 80 countries where open banking regulations either have been or are currently being introduced. Of the total countries identified, 74 are in the implementation stage or are under consultative review.

Q2 2022 Regulatory highlights

Europe and the UK are moving toward a broader open finance framework with cross-sector data sharing, as seen in the EU Commission Digital Finance Strategy and the UK Smart Data Initiatives.

- The European Banking Authority (EBA) proposed amendments to the technical requirements for strong customer authentication. A PSD2 review is also underway

- The UK is reviewing future oversight of the CMA’s opening banking remedies. Some critical regulatory bodies have revealed their plan to create a joint regulatory oversight committee to oversee development beyond the remedies’ scope

Canadian regulatory momentum is picking up again in North America after some delay. As the result of the final report on open banking, released in Q2 2021, an advisory committee has been established and an open banking lead appointed.

Thailand recently consulted public feedback on a digital economy framework in the Asia Pacific region, while Australia seeks to extend the CDR rules to telcos and open finance.

Brazil is still the leader in Latin American regulatory development, implementing its final open banking phase and the official launch of Open Finance Brazil. Additionally, the Central Bank of Brazil tightened its acquired capital rules for fintech to further enhance competition in the Brazilian payment sector.

In the Middle East & Africa, Israel launched an Account Information Service law and is currently reviewing public feedback on a Payment Services law draft. Elsewhere in the region, Nigeria’s open banking implementation progresses with the establishment of a Data Protection Bureau.

Outlook for the coming year

Key countries in the Asia Pacific region continue their 2022 open economy agendas:

- In Australia, the CDR framework has extended to other sectors, and open banking is being established in New Zealand

- A mandated open API framework is in the process of finalisation in Hong Kong

- In India, the Account Aggregator framework continues its growth, with an increasing number of accounts linked through public sector banks

- Open banking and open finance guidelines are rolling out in Indonesia and the Philippines. Thailand is also laying out plans for a framework for a digital economy

Beyond open banking, Europe and the UK are formalising and regulating the environment for data sharing in the broader financial sector. They’re also working across sectors, anchored by the European Commission Digital Finance Strategy and the UK Smart Data Initiatives.

In the coming months, regulatory development in Latin America will primarily be driven by activities in Brazil and Colombia. We expect regulators to continue introducing guidelines for a complete local framework implementation by the end of this year. Brazil expects to mandate open finance (BCB) and open insurance (SUSEP) frameworks, while Colombia plans to introduce a voluntary open banking framework.

The US Consumer Financial Protection Bureau held a series of public consultations in 2020-2021, including discussions on consumer access to financial records and consumer data held by large tech payment platforms. Additionally, progress was made by US and Canadian regulators to formalise an open finance environment by 2023, though data privacy concerns may delay the US implementation.

In the Middle East & Africa, countries like Israel, Nigeria, Saudi Arabia and South Africa will be essential to watch. Elsewhere in sub-Saharan Africa, initial work to achieve open banking by 2025 has also begun.

- Nigeria is laying down specific open finance implementation guidelines (initially introduced in February 2021)

- South Africa continues working toward open finance with the recently introduced Protection of Personal Information Act and the ongoing public consultation on open finance

- Israel is promoting open banking with legislative reforms

- Saudi Arabia is working to implement an open banking framework

The article was based on our Q2 2022 Open Banking and Open Finance Trends report.

Click here to download the full version.