New report release: Q3 2022 Open Banking/Open Finance Business Models and Use Cases

Open Banking / Open Finance

3 min read

Written by Spencer Perkins &Phuong Pham &Mark Boyd

Share this article

At Platformable, we have just released our Q3 2022 open banking/open finance business models and use cases report.

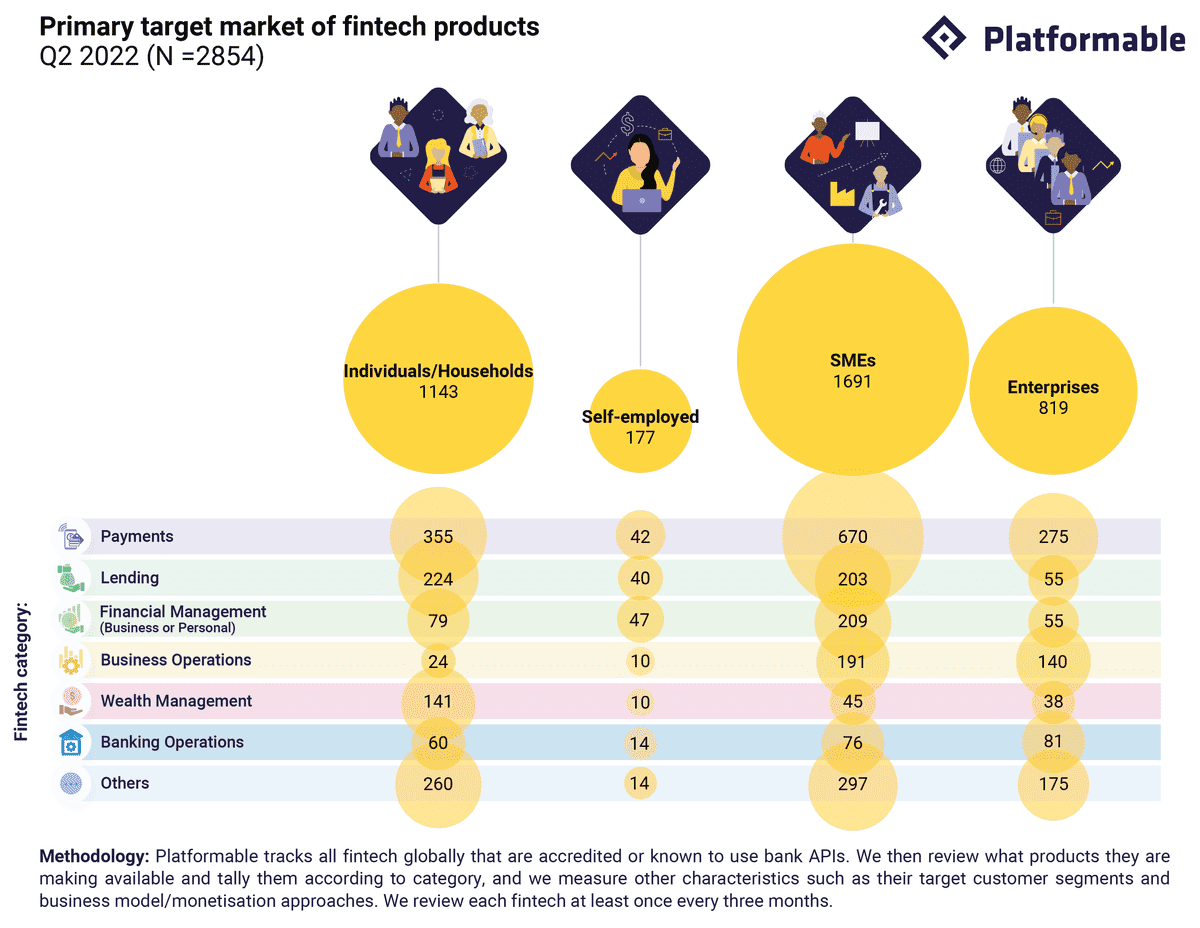

Our August report includes data on API business models and pricing strategies being used by both banks and fintech as API providers. We also look at what audience segments fintech is being built for. Our profiles of Banco de Brasil, fena and Finansystech describe API products targeting government use cases, transparency in pricing strategies, and middleware solutions for fintech ecosystem builders.