Q2 2022 Open Banking Trends: Open Banking platforms start to explore new business models

7 min read

Different business approaches available to API providers

The willingness of banks to experiment with new business models using APIs can indicate open banking maturity. There are several routes a bank can take to monetise their APIs:

- Generating revenues by offering capabilities through a partnership program - partner API integration and revenue sharing implied - or as paid premium APIs. 346 banks we track have chosen these business models.

- Offering a pool of funding and mentorship to early stage startups or acquiring existing fintech to extend API capabilities with speed. 37 banks have publicly launched these tracks to recruit their fintech partners.

- Lending third-party providers a banking licence and secure banking capabilities to offer white label financial services (BaaS) to the partner’s end-users. Globally, 43 banks have explicitly commented on a BaaS strategy, including universal banks such as HSBC, Goldman Sachs, and Standard Chartered. US community banks are also actively seeking new revenue opportunities through embedded services, although some of them do not have a developer portal.

- Fully embracing an open ecosystem approach by offering marketplaces that allows third-party apps and providers. The UK’s Starling Bank and Singapore’s DBS Bank are exemplary in this model.

Banks often embark on their API program by offering open APIs to third-party providers free of charge: we tracked 1,560 platforms at the end Q1 2022. We have observed that just by opening up their APIs, indirect values can be generated, such as from higher customer acquisition and retention.

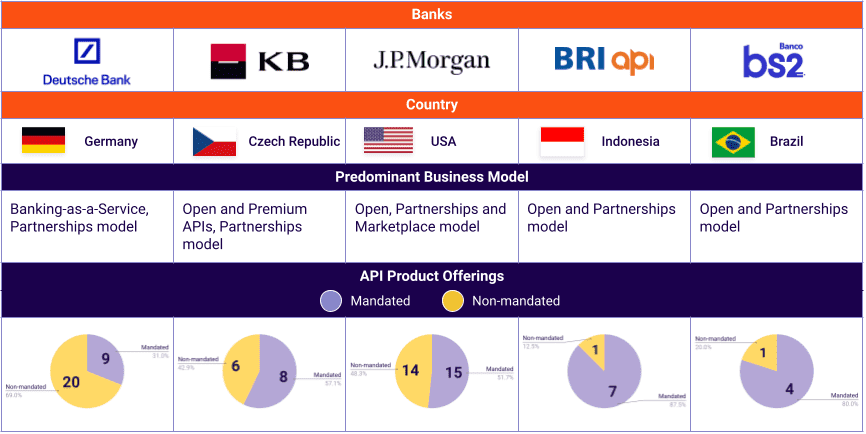

Deutsche Bank: Embedded finance with an API-first mentality

Embedded finance APIs increase value for partners

In 2021, Deutsche Bank won a BAI Global Innovation Award for their Embedded Finance Initiative, which highlighted the bank’s range of APIs and embedded finance options as well as their API-irst culture.

Deutsche Bank’s developer portal contains APIs for all banking sectors (private, corporate and enterprise) as well as sandbox and production environments for their acquisition, norisbank. By integrating these APIs into third-party apps, partners can offer their customers bank accounts and credit cards or use Deutsche’s business bank features in their own IT landscapes.

Finanzguru partnership utilises customer data for financial assistance

Financial assistance app, Finanzguru, uses the Deutsche Bank API Program to integrate Deutsche Bank customers’ personal and financial transaction data into their own application. Artificial intelligence (AI) analyses the integrated API data to alert the app’s users to potential savings and provides an overview of the user’s contracts and finances.

Finanzguru is a member of the Deutsche Bank Partner Network, an application-only network for data-driven, third-party applications to test and rate new Deutsche API products. Deutsche provides these members support and early access to data during new product development.

Komerční banka (KB): An open banking strategy beyond PSD2 compliance

Embracing partnership with fintech both technically and commercially

KB offers three streams of API services:

- Open services include exchange rates, bank product and mortgage calculator APIs.

- Partner services allow access to secure customer data and information under partnership agreements.

- PSD2 services include mandated accounts and payments APIs.

It also offers a suite of selected partner APIs that enable transaction data to be integrated into enterprises’ EPR systems and help streamline their banking processes.

Developer portal includes DX best practices like a catalogue, guidelines, sandbox and use case descriptions.

Piloting partner APIs focus on KYC onboarding and batch payments

For the partner services, KB now offers Contact Request API, which allows seamless referencing of their clients’ demand for KB’s financial services back to the bank. Several other KYC and client onboarding, electronic statements, and batch payments are in the pilot phase. Partner APIs enable an affiliate revenue sharing model for the creation of products and services.

The Czech invoicing app Fakturoid uses KB’s PSD2 APIs to integrate financial transaction data to its app to help streamline invoicing and banking processes for SMEs and sole traders. Fakturoid had 14,000 active users over one year after the launch, with a 24% conversion rate.

JP Morgan: A market-driven open banking platform

A wide range of API product offerings

JP Morgan’s developer portal groups API products into four commercial solutions, mostly targeting enterprises:

- Research & Markets includes data and analytic APIs that enable trading execution solutions.

- Treasury & Merchant consists of corporate account & payment APIs that enable innovative enterprise cash management, liquidity and reporting solutions.

- Securities Services is made up of data APIs for proprietary trading activities.

- Account Services for individuals include account and payment APIs such as PSD2 mandates.

The developer portal has DX best practices (sample codes, sandboxes, guides, SDK) but registration is required.

Embedded finance opportunities

Their API catalogue implies a marketplace business model and BaaS/embedded finance opportunities:

- Offering both traditional functionalities (bank products, corporate account transactions, payment initiations) and wider financial services (KYC/onboarding, trading, data).

- Including APIs released from partners.

Several of the third-party API products would also require the end customers to create a bank account or access other bank products to use the third party’s services, thus driving new customers and bank product revenue.

Bank Rakyat Indonesia (BRI): An open banking platform for financial inclusion

Engaging developer portal

BRI’s API catalogue is mostly made up of account transactions and payment functionalities within Bank Indonesia’s guidelines:

- Transactional APIs include six payment functionalities (direct debit, e-wallet, payment code, transfers, and cardless cash withdrawals)

- Informational APIs enable access to account transaction information and statements.

Their developer portal is in both Indonesian and English, and includes use case descriptions and documentation for each API. This implies that the bank targets both local and international partners to commercialise its APIs.

Reaching wider groups of end users

BRI’s use case page describes consumer case studies of the bank’s APIs. Each use case is organised into the consumer description, their challenges, how the bank’s APIs helped and the integration process.

These case studies also showcase the bank’s key capabilities in payment solutions for inclusive fintech apps: Doku (backend payments), TDM (financial management system), Mitra Pajakku (tax revenues), KUFI (P2P lending) and Indogrosir (e-commerce).

It appears that there is a cost in consuming the APIs, although there could be new revenues generated from new accounts acquired from leveraging relationships with third-party providers, e.g., Ayoconnect.

Banco BS2: A digital bank with new partnership opportunities

APIs and instant payments adhere to Brazil’s open banking standards

Banco BS2 joined Brazil’s open banking initiative during the launch of the initiative’s third phase in October 2021. BS2’s developer portal currently contains five APIs (banking, charge, consent flow, onboarding and PIX) which adhere to Brazil’s open banking initiative phases one and three. Plans for adherence to phase two, facilitating customer data-sharing authorisation, are in the works for later this year.

Open banking APIs facilitate new partnerships with third-party platforms. PIX API integrates with Brazil’s instant payment system by providing payment and receipt initiation and other related customer operations.

First 100% open banking services launched for corporate clients

In 2020, Banco BS2 partnered with the accountant for SMEs Contabilizei. Using Banco BS2’s open banking APIs, Contabilizei customers can seamlessly open a digital account without.

The Contabilizei BS2 Empresas Digital Account has no recurring or monthly fees, though users are required to pay for a cleared slip, withdrawals and additional Transferência Eletrônica Disponível (TED) transfers. Account capabilities include access to a payment gateway, a virtual debit card, balance inquiry and receipts in foreign currency. Open Banking Brazil Phase III will also allow users to make payment transfers from their accounts via PIX.

The article was based on our Q2 2022 Open Banking and Open Finance Trends report.

Click here to download the full version.