See you at Open Banking World Congress: 24 & 25 May 2022

6 min read

A New Hybrid Conference Format

A lot has happened in the Open Banking industry since the last time we met. The threat of COVID-19 has greatly reduced our in-person interactions over the past two years, forcing most conferences into an online space. Recently COVID infection rates have decreased, though we understand safety concerns are paramount, which is why we’re excited about the Open Banking World Congress new hybrid conference format. The conference will take place on the 24th and 25th of May in Marbella, Spain with pre-recorded virtual sessions to follow.

The in-person portion will be held at the Don Carlos Resort & Spa, with a majority of the conference taking place on outdoor stages to increase safety precautions. Spain’s COVID infection rates are low and as a bonus, the outdoors events will let attendees enjoy Marbella’s pleasant spring weather. Platformable Director, Mark Boyd, and Open Banking/Open Finance analyst, Phuong Pham, will be there—with masks on while indoors. We encourage those in Europe and the UK to join us.

Open Banking World Congress Activities We’re Looking Forward to

The Open Banking World Congress approaches community building by elevating underrepresented voices in the industry. A commitment to diversity representation is something we’re passionate about at Platformable, which is why we’re proud to be a strategic partner of the conference.

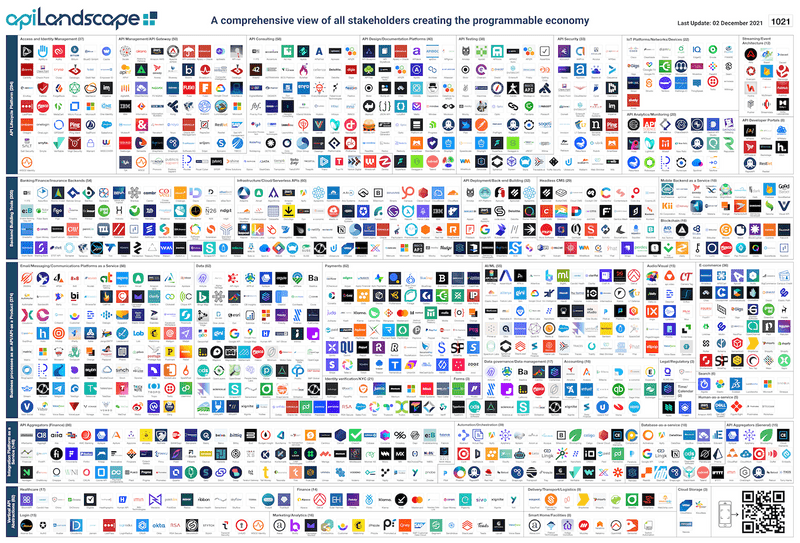

During the two full days of events, industry leaders from top banks and fintech will host panels on current and forecasted open banking trends and discuss the open banking landscape’s effect on payment institutions. We’re especially looking forward to the Banking on Change and Great Idea but How are You Going to Make Money From It? panels.

Panel: Banking on Change

This panel on 24 May at 10:00 CET gathers top banking insiders from Citi, HSBC, Societe Generale, Natwest and ANZ Bank to discuss what’s next in banking and current influences on the sector. These banks, some of which we’ve discussed in previous Trend Reports, are leading the way to bring a variety of innovative new solutions to the open banking landscape.

Panel: Great Idea, But How are You Going to Make Money From It?

This panel will take place on 24 May at 16:45 CET on one of the venue’s three outdoor stages. The five-person panel, comprised of top fintech CEOs and CCOs, is chaired by Ben Nadel, co-founder of the UK fintech founder’s group, SHIFT. The panellists will discuss making money and ways to create returns on open banking for the CMA9—the UK’s nine largest banks and building societies.

As much of fintech is still in its nascent stage, it will be interesting to hear what these industry leaders have to say about commercial opportunities with open banking. In our Open Banking and Open Finance Q1 2022 Trends Report, we tackled the lack of variety in customer segment ideation and the importance of financial inclusion in the open banking and open finance ecosystem, so we’ll be listening closely to learn how banking returns can also benefit underbanked populations.

Meetings and Roundtables

To further encourage community interaction, the conference will host a series of one-on-one meetings and roundtables, as well as a networking get-together at the end of each conference day. We’re looking forward to meeting Gravitee—whom we’ve worked with on API Complexity Survey—in person for the first time. APIMetrics—whom we’re looking to release some content with in the future—are also attending.

Virtual Events

Though we hope to see you in person, the Open Banking World Congress is also hosting virtual events for those who aren’t able to attend. Some of these online events will include new pre-recorded sessions, case studies and regional outlooks. To make virtual attendees feel like they’re a part of the action, the Open Banking World Congress also plans to host a series of live interviews and debates with event speakers, for attendees to interact with as they watch.

We’ll also be following up on the conference with reports based on interviews and outreach that Mark and Phuong will be conducting in person.

As COVID-19 infection rates continue to decrease, we hope this will be the first of many hybrid and in-person conferences. If you’re interested in attending, please let us know, as we have a discount for our community members.