Q2 2022 Open Banking Trends: We need more API-enabled fintech meeting the specific needs of customer segments

7 min read

Payment solutions still account for the majority of fintech built with open banking and open finance

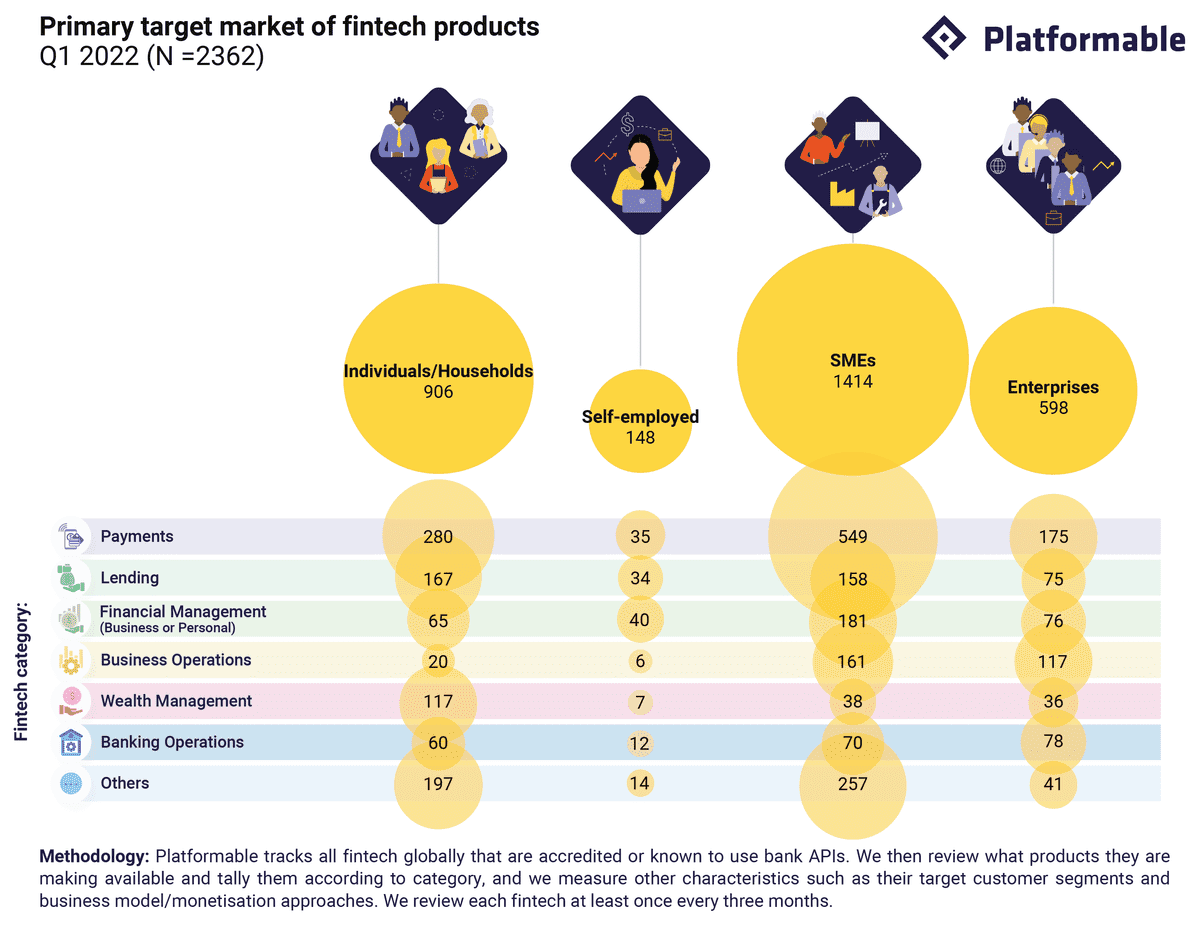

We currently track 2,362 fintech that either use open banking APIs or are fintech platforms in their own right. Of this number, 100 are API aggregators specialising in harmonising fintech and bank APIs to speed up product development.

Most payment back-end and infrastructure—like FX services and B2B payment service providers—are headquartered in the US and Europe. These providers meet SMEs’ increasing needs for streamlining and payment process cost reduction with customers and suppliers.

There is also a large number of account keeping, budgeting and account/API aggregation fintech that offer generic bookkeeping and financial management solutions to SMEs. These offerings reflect the first wave of products built with open banking APIs in Europe and the UK under PSD2.

Other fintech apps built with open banking and open finance include digital banking, card and wallet management, consumer lending and credit services, and alternative lending. Many of these offerings target individuals and households.

Account aggregators and providers of digital banking, payment infrastructure, data analytics and card management are also leveraging their B2B2C capabilities to tap into opportunities in embedded finance. Such examples include Flutterwave, Grab, Mollie and Railsbank.

The bulk of API-enabled fintech target SMEs and individuals

Like last quarter, SMEs and individuals/households are the top customer segments targeted by fintech using open banking and open finance APIs. Products targeting these segments account for over 90% of all fintech globally. The most popular categories for SMEs are payments (549 total products) and financial management solutions (181 total products) that enable SMEs to streamline banking and transaction processes. Similar products focused on individuals and households aim to cut payment transaction costs (212 products) and/or enable better management of financial health (57 products).

These products tend to be fairly generic and do not target sub-populations within that broader segment by designing specific features that meet the needs of end-users. However, some do take a human-centred, design thinking approach. We welcome those solutions, such as Stilt, a credit provider for immigrants in the US, Grab, a financial services platform for ride-hailing drivers in Southeast Asia, and TerraMagna, an embedded financing provider for farmers in Brazil.

Since last quarter, we’ve also seen some growth in business operations (65 products), including data analytics to support SMEs in leveraging financial data and fintech digital transformation in their businesses.

Fintech highlighted in Q2 2022

We see an emergence of new fintech apps built with open banking and open finance focusing on B2B2C opportunities, some of which specifically target the inclusive financial segment. Of note are the Nigerian payment back-end and infrastructure provider Flutterwave, Indonesia/Singapore-based ride-hailing app Grab, the Netherlands-based payment integration platform for SMEs Mollie, the UK-based BaaS solution provider Railsbank and the US open banking platform Trovata.

Flutterwave: From payment solutions to Fintech-as-a-Service offerings

As a payment back-end solution provider, Flutterwave provides SMEs in Africa with market access and scalability through API-enabled payment options that integrate with payment systems (Mono), online account keeping and e-invoicing apps (Xero, Intuit, Sage).

Recent new product launches reflect a platform business model and strategic focus on inclusive finance:

- Flutterwave’s marketplace allows businesses to sell their products online and offers remittance services for consumers making international payments

- So far in 2022, the fintech has added SME lending, card issuance and embedded finance to its product suite

Flutterwave is opening up its infrastructure via API integration to allow other companies to embed its financial capabilities into their existing products.

Their FaaS offering provides a unified tech stack that includes KYC, account opening, debit card issuance, payments and real-time transfers through a single endpoint, as well as account servicing and compliance.

Grab: An exemplary embedded finance practice for financial inclusion in Southeast Asia

Grab has created a financial ecosystem by connecting drivers, merchants and customers on its ride-hailing and food delivery marketplace. The company now offers a full suite of financial products and services to both individuals and businesses, including payments, alternative financing, insurance, wealth management and rewards.

Bank partners have embedded their capabilities into the Grab ecosystem across Southeast Asia:

- Citi Singapore made its consumer lending and reward products available to Grab users

- KBank partnered with Grab for their e-wallet launch in Thailand

- ZhongAn Insurance partnered with Grab for an insurance marketplace in China

Grab also recently received a banking license to operate a digital bank with Singapore Telecommunications, which is likely to see the group increasing their embedded banking capabilities for other companies.

Mollie: A new financial services suite enabling SaaS expansion in Europe

Connect for Platforms, Mollie’s March 2022 offering, is a combined software-as-a-service (SaaS) and marketplace platform for SMEs. It offers integrated payment solutions as well as customer onboarding and improved operational efficiency. Connect meets PSD2 and other EU compliance regulations. By including onboarding and compliance in addition to payment integrations, Mollie is moving beyond payments to transition into business banking.

Mollie has also introduced an Acceleration Fund to drive external innovation in the form of integrations and add-on products for its platform. The fund, worth €1 million, targets developers, start-ups and digital agencies worldwide. In addition to funding, recipients will receive marketing assistance and access to Mollie's latest products.

Railsbank: A BaaS provider expanding into new areas

Railsbank launched in Australia last year via a partnership with Volt, the country’s first neobank. The Australian launch is a continuation of Railsbank’s expansion into the Asia Pacific region. As a result of the partnership, Volt plans to utilise Railsbanks’ network of partners and customers, as well as enable a broader BaaS solution for companies to prototype, launch and scale financial products with their own customer experience (CX) options.

In November 2021, card and wallet management app, Douugh, partnered with Railsbank to expand their banking services. Using Railsbank’s embedded finance tools, Douugh plans to offer core-banking services to its customers in the UK, Europe and Southeast Asia.

Railsbank’s Volt partnership also allows Douugh to leverage Volt’s banking license to offer products like bank accounts, debit cards and financial management services to their Australian customers. Douugh is expected to launch their Australian app in mid-2022.

Trovata: New enterprise and mid-market open banking payment options

In December of 2021, Trovata added a payments app to their cash management platform. The new app allows businesses to make transfers and send payments via ACH, wire and Real-Time Payments (RTP) directly via the bank’s APIs, cutting out the need for a third-party intermediary. App users can also govern payment executions in adherence with their company’s signature authority matrix, treasury policy and internal controls. Additionally, settlement (via RTP) and reconciliation is automated to improve payment processing efficiency and increase RTP adoption in the US.

Capital One partnered with Trovata early this year to distribute Trovata’s cash management platform to new and existing clients in the commercial and corporate banking sectors. Capital One’s customers can expect improved visibility, insights into multi-bank account balances and historical cash flows from the platform. Projections to help customers automate cash forecasting are also included.