Q1 2022 Open Sustainability Trends: 8% of European Fintech Market Using Open Banking APIs Is Green

12 min read

Share this article

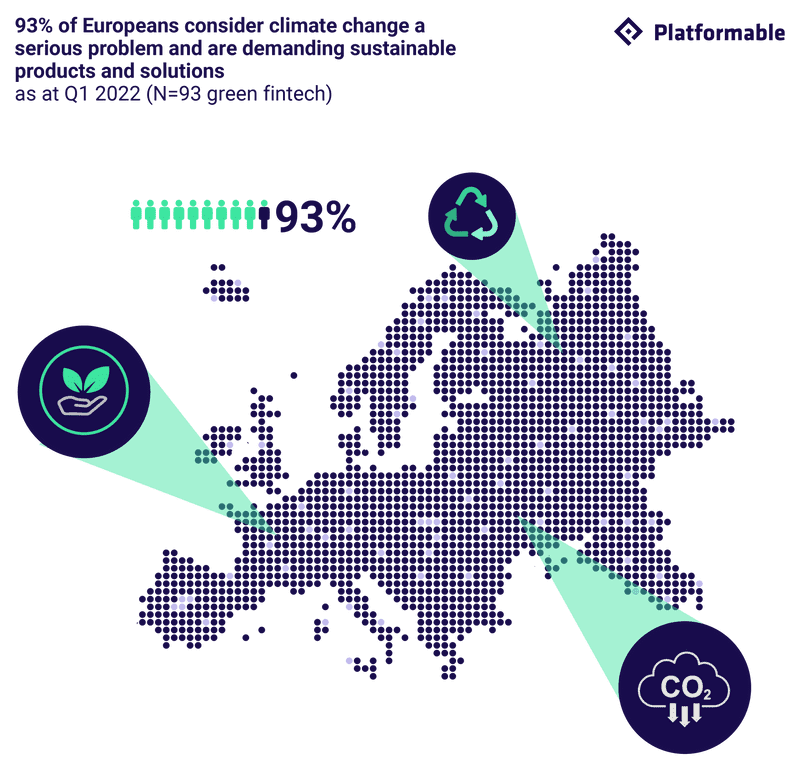

Green fintech operating in Europe and the UK are heavily focused on climate change mitigation. As part of Platformable's Q1 2022 Open Sustainability Trends report, Using Open Banking and Open Finance APIs to Build Green Fintech, we monitor the creation of sustainability products using open banking APIs by breaking the product types into eight categories. This taxonomy allows us to study the sustainability solutions being made available by third parties and to see which groups these solutions are marketed toward. We also look into the diversity in companies offering sustainability products and into the real world impact these products could have.

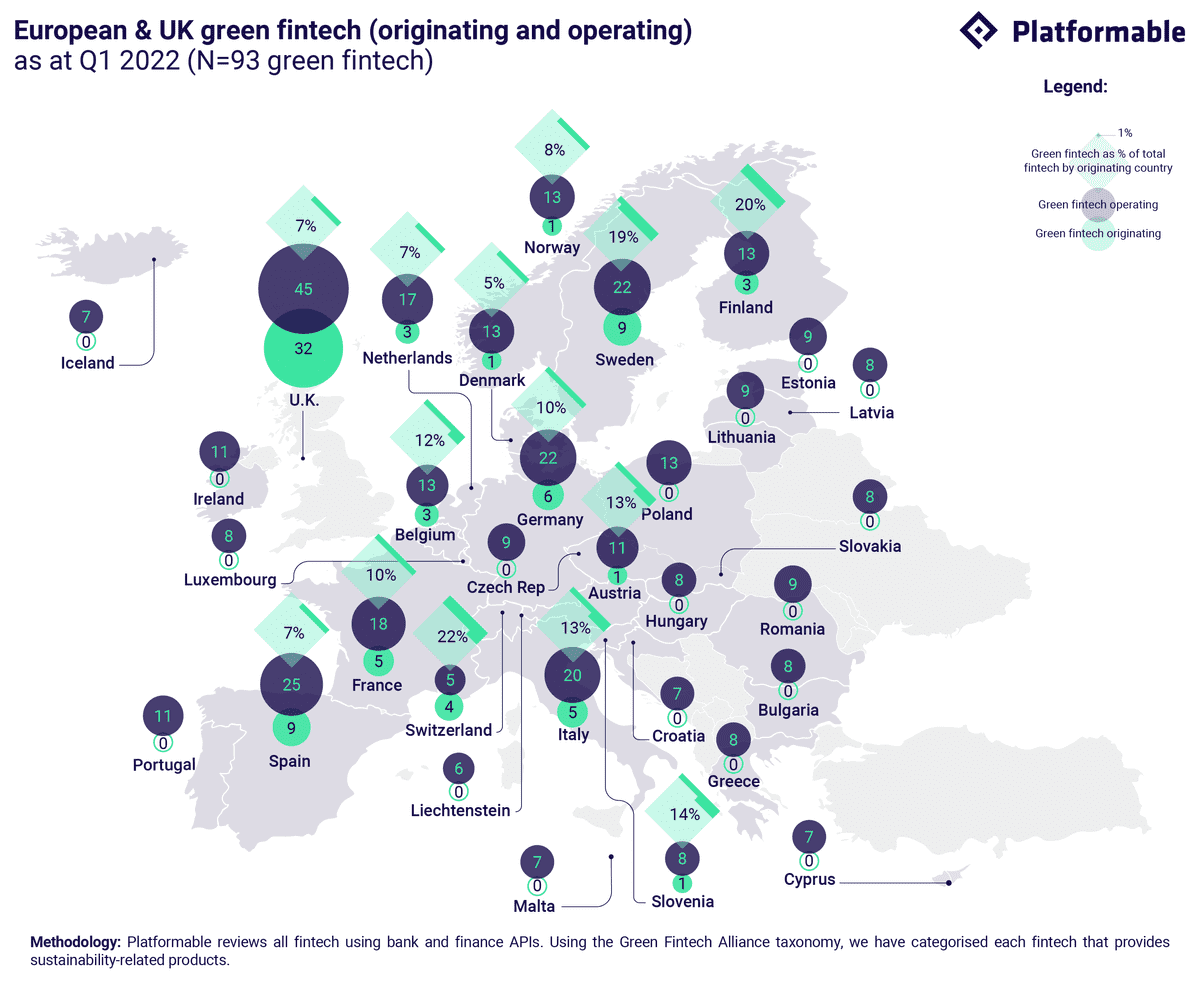

8% of all European and UK fintech using Open Banking APIs have a sustainability product

93 green fintech (out of 1,133 European and UK-based API-enabled fintech) offer products or solutions that focus on creating environmental value and sustainability benefits.

On a country-wide level, the UK offers 32 home-grown green fintech, with 45 operating in the country. Spain, Sweden, Germany and Italy each count between 20 and 25 green fintech operating in each country.

Switzerland, Finland and Sweden have the greatest proportion of all home-grown fintech with a sustainability product offering (with 19-22% of all fintech originating in each country having a sustainability focus or feature-set). The Nordic countries’ long-term commitment to environmental protection appears to have impacted on the fintech cultures of Finland and Sweden, in particular.

UK’s open banking standard, which enables fintech to integrate APIs from all banks more easily using a consistent API template, and the level of fintech expertise in the UK has spurred this leadership position in the absolute number of green fintech products made available (32 products).

The Green Fintech Taxonomy describes 8 product categories

Green fintechs are categorised into eight categories based on their sustainability product focus. Categories used for the Green Fintech Taxonomy are based on the Green Digital Finance Alliance’s work.

A fintech is considered a green fintech if it offers features that address sustainability as a part of its product or service.

We are seeing fintech enter the sustainability space in a number of ways:

- Some fintech are entering directly and are building green fintech as their main product

- Some fintech with an existing product range are adding a dedicated secondary product that has a sustainability focus

- Some fintech are adding sustainability features to their core product.

In each of these cases, the products is counted as green fintech.

This research focuses on measuring green fintech built on open banking and open finance APIs (that is, those operating in the open banking/open finance ecosystem). This is a smaller subset of the larger, digital sustainability/climate tech market.

40% of green fintech products are payment and account solutions

PSD2 Accounts and Payments APIs have enabled the greatest category growth, with 40% of green fintech products (37 in total) in the Green Digital Payment and Account Solutions category.

Products in this category include:

- Adyen, a payment back-end and infrastructure solution, which has built integrated donation features to allowing customers to donate to environmental restoration projects

- Svalna, a carbon footprint calculator allowing banks, other fintechs, financial institutions and merchants to quantify account transaction data by their potential carbon footprint

There are 17 Green Digital Investment Solutions are available, including:

- Sustainable investment service Micappital Eco

- Climate friendly pension funds, such as PensionBee’s Fossil Fuel Free Plan

The ‘Others’ category includes 11 services where the initiating action comes from outside finance, but financial services then enable action to be taken, for example:

- GridPocket, which analyses energy consumption to identify energy switching options

- iChoosr, a group-buying solar energy purchase scheme offered to households via local councils.

Individuals and households are the biggest target market for green fintech, which limits potential to create the greatest impact

Current offerings skew towards individual action

While some green fintech targets both individual consumers as well as business and enterprises, in absolute numbers there are more products (52) focused on the individual/household market. Just over a half of those have the potential to be used to reduce emissions from transport (26 products) and/or building energy use (30 products), for instance, by removing upfront costs from household solar panel installations or by financing electric vehicles.

Unrealised potential for emission reductions

Overall, only around 30% of products target each of the greatest causes of greenhouse gas emissions. This reflects an ambition gap as some of these sectors, such as industry energy use, will be challenging to decarbonise.

Recent policy and regulatory drivers across Europe, in particular, may see the creation of new product markets addressing the circular economy and sustainable supply chain management, however, this is not evident in current green fintech developments.

90% green fintech solutions focus on climate change mitigation

The overwhelming majority (90%) of the 93 API-enabled green fintech operating in the UK and Europe, focus on climate change mitigation. Green fintech were categorised according to the environmental objectives defined by the EU Taxonomy Regulation passed on 18 June 2020, which found that in addition to ‘climate mitigation’ around a third described other potential areas of impact. Overall, the majority of green fintech used generic terms such as “green”, “sustainable” or environmental” action to describe their potential impact.

For instance, many digital investment and ESG data and analytics solutions state a broad ESG focus in their fund allocation and data collection strategies. Detailed information on which companies are being invested in, or the exact ESG data points being collected, was often not available.

Therefore, unless otherwise specified, these solutions are coded to contribute towards all 6 categories. Current policy and regulatory work in Europe is aimed at improving assessment of impact claims made by green fintech.

17% of all green fintech rely on offsets, an as-yet unproven solution

The EU Taxonomy Regulation describes potential impacts of products as ‘enabling’ and ‘contributing’. As at Q1 2022, 23 green fintech products have an enabling, awareness raising focus. Enabling actions are informative but not directly actionable, for instance, personal carbon footprint calculators or an enterprise ESG data dashboards that show a performance baseline.

Contributing actions allow the end user to take action within the product, such as comparing and switching to a green energy tariff or pension funds that let savers transfer their contributions to fossil fuel free funds.

16 products offer carbon offsets as their primary or only sustainability action, 13 of which are payment and account solutions. There are qualitative differences between offset methods, but globally, the large majority of current offset projects raise environmental and social integrity issues. Several providers select carbon offset initiatives that have been accredited under the UN’s Climate Offset Platform, but further clarification is needed to assess offset-only actions integrated into green fintech products.

Greater guidance is expected in future to assist with more accurately assessing green fintech as having an enabling or contributing impact, and to resolve concerns regarding the quality and potential of carbon offset initiatives.

Banks and API aggregators can play a more active role in the open sustainability ecosystem

Open ecosystems foster relationships between various stakeholders, ranging from collaboration, complementary actions, co-creation, coordination and competition. 52 of the 93 green fintech identified in this research have more than one relationship with another stakeholder in the open banking ecosystem. An analysis of current relationships found:

- Only a few bank platforms approach green fintech as a specific target segment. The majority do not currently go beyond making open banking APIs available for all fintech, including green fintech, to integrate with and build new digital products

- API aggregators could offer green fintech multi-bank account integration and data capabilities. Only six out of 57 API aggregators operating in Europe and the UK appear to have green fintech integrations

- Account aggregators could actively target green fintech as a use case to encourage building innovative solutions in a couple of ways. For example, they could:

- Describe sustainability use cases for their existing API offerings

- Create partnership opportunities to build green solutions.

Green fintech is more diverse than broader fintech, but improvement is needed, especially in management diversity

Only two thirds of green fintech have women in leadership

68% of European and UK green fintech have women in their leadership teams. The situation is more balanced than is seen in fintech overall, where only 57% of all fintechs have women in management or leadership teams.

Green fintech is more diverse, but most teams are still all white

Understanding diversity management is challenging as business registration data in Europe or the UK does not collect data on the ethnicity or race of founders or management teams. Using a consistent methodology to identify management team composition, 42% of all fintech have some degree of ethnic or racial diversity in their leadership teams, compared with only 34% of fintech overall.

Green fintech could play a part in reducing climate impacts on underserved populations

Climate impacts are disproportionately felt by already marginalised groups and communities. Some initiatives (although very few at this stage) are focusing on addressing this inequality risk in their products:

- NLB Agro in Europe provides access to finance for young and early-career farmers to adapt their farming practices to climate change.

- The prepaid electricity provider Energie Revoltie allows people with lower incomes to control their electricity bills.

- Carbon calculator Doconomy has partnered with the UK-based Algbra to enable ‘financially overlooked’ customers to measure their carbon footprint.

The European and UK green fintech ecosystem is just commencing, but needs greater clarity of vision to become impactful

Overall, it is promising to see the open banking and open finance industry actively working on sustainability. However, there are real concerns that should be carefully addressed as market activity increases.

More product ideation needed on high-impact use cases

At best, 30% of emerging green fintech products currently target the greatest causes of greenhouse gas emissions. The majority of these are focused on individual awareness or action, which can further limit the impact potential of the new green fintech products and services being provided. While raising awareness for all, including individual and household consumers, is important, greater steps forward can be taken by supporting businesses, enterprises and industry sectors to adapt their spending habits or operational processes to improve sustainability outcomes. The number of transport and building energy green fintech solutions in particular could be improved.

Offsetting solutions need to be accredited and carefully assessed

17% of current green fintech products and services focus solely on supporting business-as-usual models that rely on the logic of cleaning up afterwards via paying for offsets as a sustainable solution. There are offset projects with real impact potential: for example, the Stripe Climate initiative which allows businesses to dedicate a percentage of revenue to fund carbon removal projects provides much needed funding for technologies and brings them towards market maturity faster.

However, the more commonly promoted tree-planting programmes should be more closely scrutinised. Some are certified to meet high quality criteria, but many are associated with human rights concerns and biodiversity threats and may ultimately end up doing more harm than good.

Lack of transparency may weaken consumer trust and market growth

It is difficult to assess the sustainability claims of several green fintech products solely from their product features and descriptions. It is not clear how the products operate, and vague marketing language (‘green benefits, eco-friendly’ etc.) without metrics describing impacts is common. As an emergent industry, it is understandable that there are limitations in the metrics able to be reported on impacts to date. However, if this trend continues, it can slow down adoption by weakening consumer trust in the market overall.

Regulatory initiatives including the UK guidance within the consumer protection law to reign in businesses making misleading or baseless environmental claims and the EU Taxonomy Regulation on sustainable investments, as well as an upcoming Green Claims Initiative are expected to strengthen business accountability and offer clarity for consumers. Green fintech can start by sharing data on the evidence that was used to define their sustainability approach and report regularly, through blog posts or updates to product feature pages, on the impacts-to-date amongst their early adopters.

Business and pricing models for green fintech are at a nascent stage and need to be market-tested

The World Economic Forum recommends six key actions to identify potential business models for sustainability-focused products and services, as shown above.

Only 1 in 5 (19%, or 18 products) of green fintech currently describe a pricing model for their products and services. Of these, transaction volume is the most common form of pricing model (8% of all green fintech, or 44% of green fintech with a clear pricing strategy) and is used by eight payment and investment-related products. Two loans products charge interest rates as their revenue source, five products offer subscription-based pricing, and three have a flat-fee charged on completion of a service delivery event.

Interested in learning more about sustainability in the open bank and open finance sectors? Check out the full Open Sustainability Trends Report.