How is Cushon using open banking and open finance APIs to help tackle climate change?

7 min read

Why do we need green fintech?

The climate and the environment are in crisis. The latest series of IPCC reports is harrowing, and data scientists, lawyers and the youth are just some of the groups scared and frustrated in the face of sluggish progress towards a greener future. A senior safety consultant of Shell has recently publicly resigned accusing the company of extreme harm to the environment, and the UN secretary general is calling for new graduates to “not work for climate wreckers''.

The need and calls for action are clear, and finance is one of its most powerful tools. It’s becoming clearer that many financial institutions' net-zero pledges and climate commitments cover operational emissions but fail to disclose or account for the wider emissions produced by their investments and financial instruments. These emissions are much larger in scope and therefore have significantly greater impact potential - and are much more dangerous if ignored.

Consumers and regulation are also increasingly demanding sustainability, including banking and finance products. According to a 2021 survey by YouGov, 4 in 5 of Europeans say businesses play an important role in addressing climate change. Beyond consumer demand, the need for sustainability action is driven by regulation and quickly emerging requirements for businesses to act and report on Environmental, Social and Governance (ESG) metrics and impacts. As is the case for instance with the open banking regulations in Europe, regulations obligate but also help open up new markets by creating common operating structures and demand and encouraging the development of new solutions that help stakeholders comply with the new regulatory context.

Introducing green fintech: Cushon

Marketing manager Louise Howorth described their products and how they use directing investments as a form of creating impact. “At Cushon, we genuinely care about the environment we live in, and help our customers to create a better financial future worth saving for'', said Howorth. According to Howorth, the pension’s default investment strategy is sustainable and achieved through a mix of investment related carbon reductions (60%) and through offsetting (40%) via verified offset projects paid for by Cushon.

Directing investments as climate change mitigation

To be able to evaluate and understand the sustainability impacts of any green fintech solution or product, we categorise the impacts according to the environmental objectives defined by the EU Taxonomy Regulation:

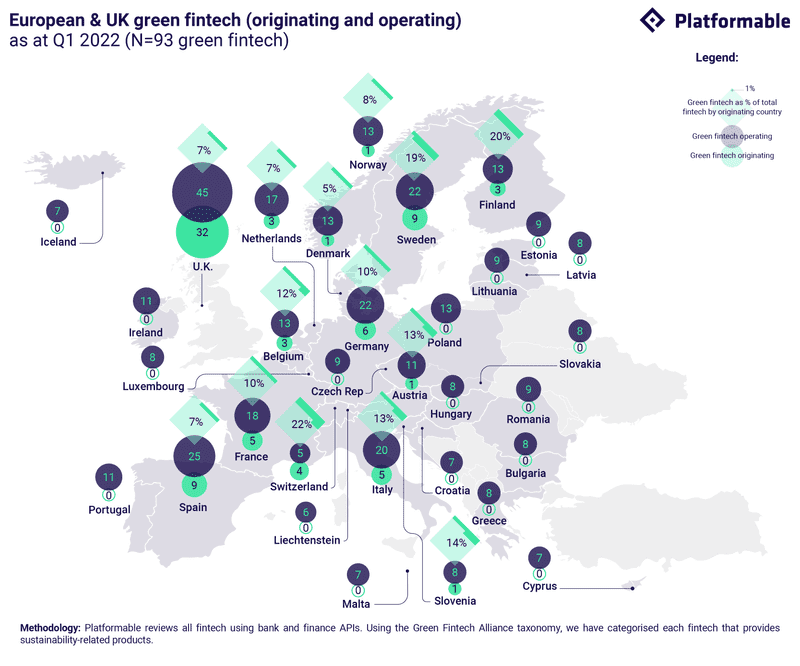

The overwhelming majority, 90%, of the 93 API-enabled green fintech operating in the UK and Europe focus on climate change mitigation. Cushon’s net zero pension is also categorised as a climate change mitigation tool as it targets the greenhouse gas emissions of pension savings through addressing what are called “financed emissions”. A 2021 report by Rainforest Action Network (RAN) and various other environmental institutions found that multinational banks spend billions of dollars annually to fund fossil fuel production. This practice, known as financed emissions, centres the enabling role that finance has - or doesn’t have - on the green transition.

Cushon is a part of the wider campaign Make My Money Matter campaign pushing for environmentally sustainable pension investments.

What roles do APIs and open ecosystems play?

Our value model describes the benefits of APIs for sustainability in the diagram below, from left to right:

- API providers (including banks, fintech and other environmental data providers) make APIs available, which are used by API consumers (such as fintech, API aggregators and greentech) to build new products and services which are then used by end users (individuals, businesses, enterprises and researchers) to take action to improve sustainability.

- These actions lead to impacts on society, local economies and the environment.

- Other stakeholders (including standards bodies, API tool providers and consultants, incubators, financial inclusion advocates and fintech and greentech associations) all play a part in fostering maturity and furthering the growth of this new industry sub-sector.

Cushon builds on the wider open banking infrastructure and integrates with another fintech, Tumelo. Tumelo’s Voting API allows end-users, the pension savers, to state their preference on key ESG resolutions at companies’ Annual General Meetings. As indirect stakeholders of companies in which their money is invested, the pension holders are notified of upcoming ESG issues on the agenda and can have their say.

One of the biggest value promises of open ecosystems is that they can enable wider participation across a broader range of stakeholders. According to Howorth, the desire for greater transparency and consciousness of sustainability are big customer drivers for the net zero pension. The integration with Tumelo makes sure the customers’ investments reflect their values and ultimately create climate change mitigation benefits.

Leveraging APIs and design thinking to create impactful products and services

The European and UK green fintech ecosystem is just commencing, and overall it is promising to see the open banking and open finance industry actively working on sustainability. However, it needs greater clarity of vision and stronger focus on high-impact use cases to truly deliver the scale of impact that is needed. As we saw in the earlier comparison, directing finance towards high-impact projects is significantly more efficient than many of the more familiar actions such as household recycling or individual transport choices.

How does Cushon think about their future product and feature development? Cushon acknowledges that the company’s climate performance has room for improvement. Cushon’s net zero pension’s carbon reductions currently rely on a dual model of financing zero or low carbon projects and carbon offsetting, and the company is driving for increasing transparency on the breakdown of fund allocation and reducing the share of offsets. Offsetting can serve as an interim solution, but it needs to be matched with growing ambition given the uncertainty of the long-term climate benefits and the integrity issues associated with many less rigorously certified projects.

To address this, Cushon has launched a new investment strategy with an updated catalogue of sustainability projects, increasing private market target allocation to 15%, managed by Schroders Capital. The new strategy also works to automatically direct investments towards companies that are continuously growing their alignment with the Sustainable Development Goals and moving money away from companies that do not. The ultimate goal is to stop using offsets entirely.

In the case of Cushon and the net zero pension, most of the impact creating work happens behind the scenes through the investment strategy’s growing ambition. Looking at the European and UK green fintech more broadly, at best 30% of emerging green fintech products currently target the greatest causes of emissions. Furthermore, as concern about climate change and other environmental crises is increasingly widespread and consumers are demanding new solutions, emphasis needs to shift from awareness raising to encouraging and enabling action.

One way to ensure this is to build the action in the product or solution. This is where APIs can really shine as they enable connecting various pieces of the digital user journey together. At Platformable, we have been working on an impactful design and product ideation workshop model that helps fintechs and other digital product and service providers to combine solving their customers' pain points with creating real sustainability impacts.

Book a call to discuss API product ideation with us.