Q1 2022 Open Sustainability: Three Banking Examples

5 min read

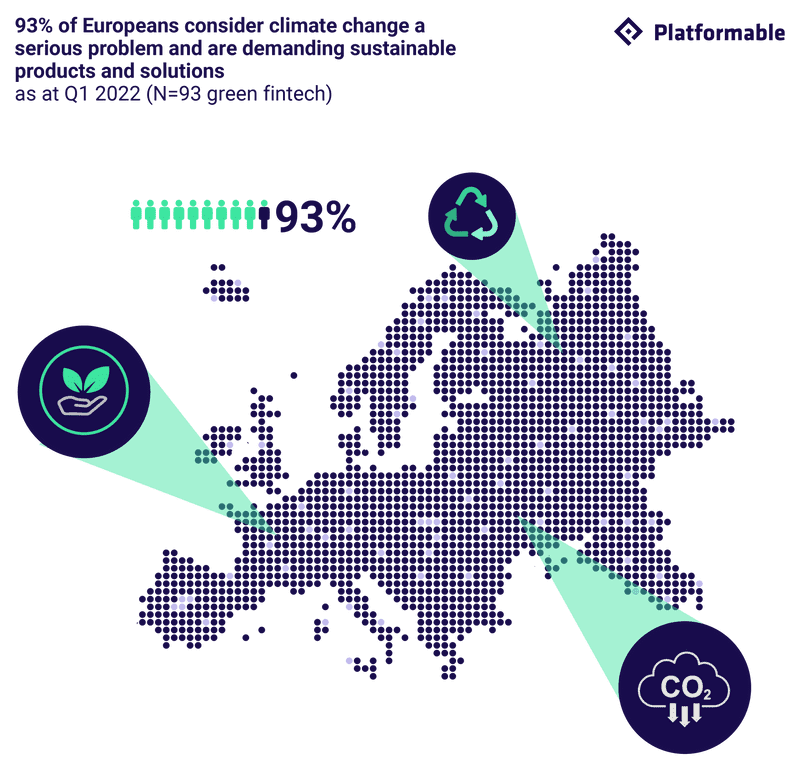

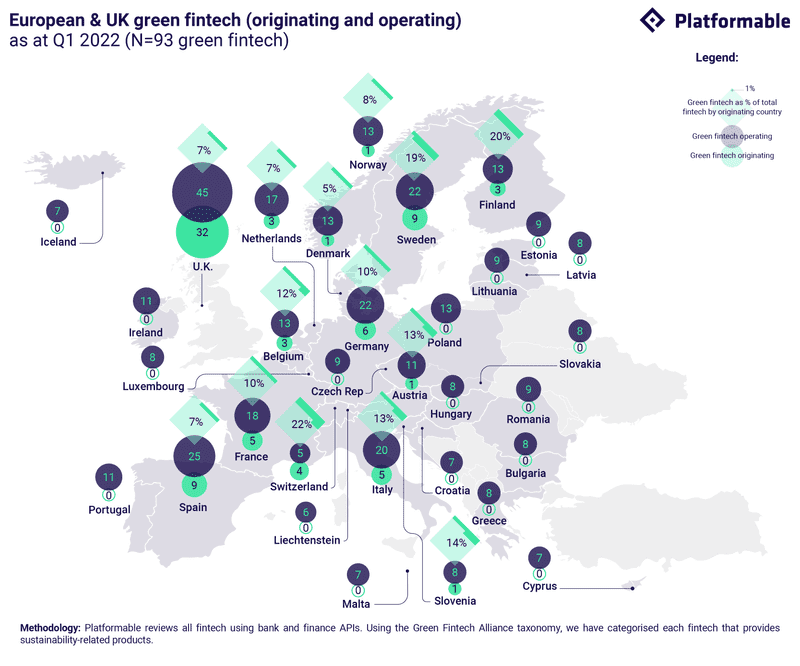

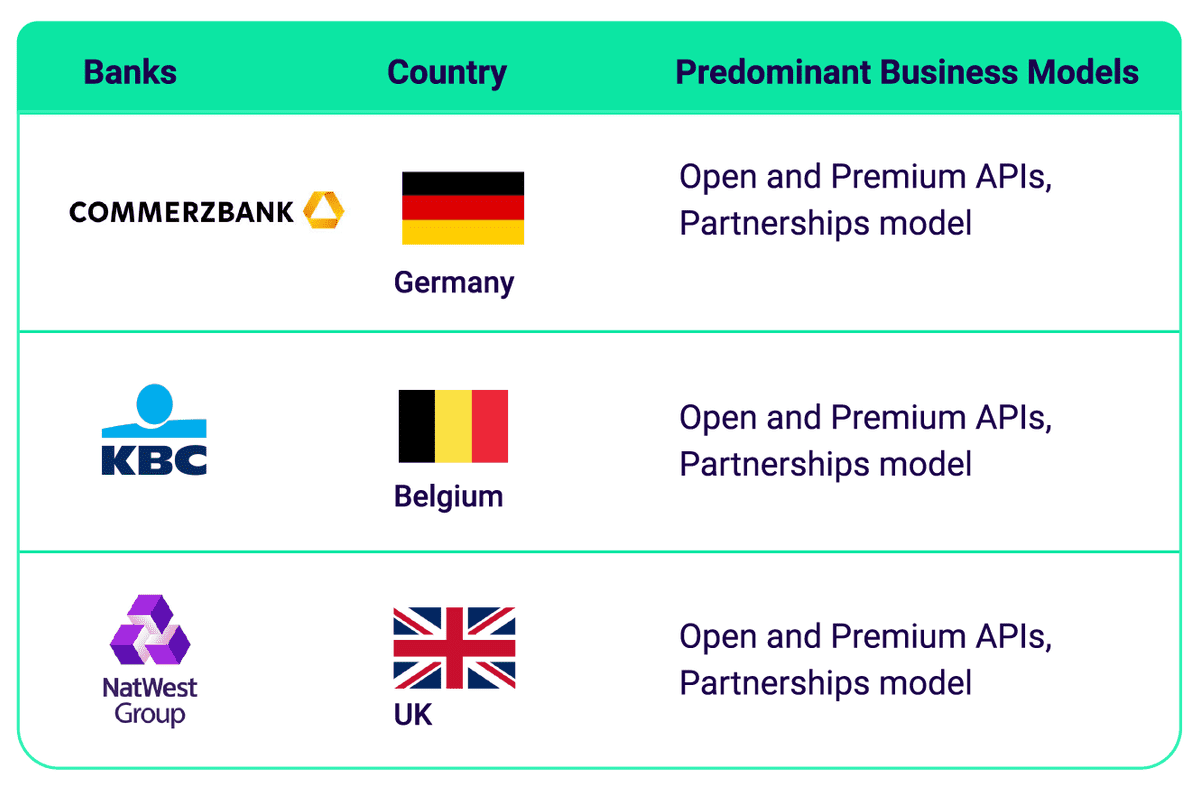

Some open banking platforms have begun to partner with fintech in an effort to create more sustainable products and services. As part of Platformable's Q1 2022 Open Sustainability Trends report, Using Open Banking and Open Finance APIs to Build Green Fintech, we monitor the transition to open banking economies, wherein bank services are available via APIs. Third parties use these APIs to create goods and services, adding value to the market. We took an in-depth look at three open banking platforms to examine how their APIs allow third parties to create sustainability-focused products.

A small number of banks are opening APIs and partnering with fintech to help create sustainable products and services

Embracing an open ecosystem approach for climate action

Leveraging API program and fintech partnerships to drive new sustainable business opportunities

Commerzbank sees API-based ecosystems as fundamental to move towards a circular economy.

In the first-of-its-kind paper, Commerzbank released a white paper describes three key accelerators: regulations, standardized platforms where data and APIs can be shared to help build new green fintech products, and customer demand.

P2B payment API integration to enable pre-paid power supply

Commerzbank includes a collaboration section on their developer portal, highlighting their partnership with the pre-paid power supplier Energie Revolte, uses Commerzbank’s Corporate Payments API to offer an instant payment method to their energy customers. The API provides almost real-time updates on payment notifications, enabling faster energy supply to their customers as prepaid energy payments are confirmed.

A recent webinar with API management provider Axway also described a proof of concept product focused on supporting companies to ensure a sustainability-focused supply chain.

A first mover in creating API products that drive sustainability actions

Putting customers’ end-to-end journey at the focal point

KBC takes a consumer-centric business and design thinking approach to its API product innovation, creating three specific APIs that create sustainable solutions:

- KBC Green Energy Loans APIs build on market interest amongst home owners to reduce their carbon footprint and promote the circular economy.

- KBC Bicycle Loans APIs target health- and environment-conscious, and convenience-oriented individuals.

- Energy Mobility APIs allow enterprises to integrate their HR management with worker payments to provide green incentives to their employees including vehicle leasing, public transport and bike budgets.

Bicycle and green energy loan APIs for integration at the point of sale

By integrating with KBC bicycle loans and green energy APIs, bicycle retailers and green energy technology merchants can offer their customers credits to finance their purchases at the point of sale, in store or online.

The APIs are free to use, but merchants and retailers are required to sign a partnership agreement, whereby they will either act as a referrer or a credit intermediary of KBC. As a result:

- KBC can generate new validated loan customers at lower acquisition costs

- Merchants tend to increase their sales by 20% if customers can access credit at the point of purchase.

Combining customer-centric business approach with fintech partnerships

Opening several acceleration tracks to recruit fintech partners

Natwest Group specifically targets businesses, offering access to the banking group’s 10 million customers. It pledges to partner with fintech for shared revenue creation.

Half of their non-mandated API catalogue are “Partner” APIs, including those providing access to customer identity and internal credit rating, illustrative loan quotes, and the bank’s internal financial crime database.

Up until the onset of the pandemic, Natwest Group was active in organising hackathons to identify and recruit potential fintech partners. The bank has also recently organised global open finance challenge - a tailored incubation programme in collaboration with some other banks.

Global collaboration for climate solutions

Green fintech solutions were amongst the four winners of the global open finance challenge:

- ValAI developed an automated sustainability rating tool and marketplace that adds insight into sustainability rating on the asset values

- Banyan developed a loan and risk management platform for renewable energy projects.

The Natwest Group and its collaborating partner banks offer a secure sandbox environment for fintech to develop their solutions. The sandbox combined open banking, open finance and experimental services, an essential component needed to support green fintech to test and build their solutions.

Interested in learning more about sustainability in the open bank and open finance sectors?