Q1 2022 Open Sustainability: Five Fintech Examples

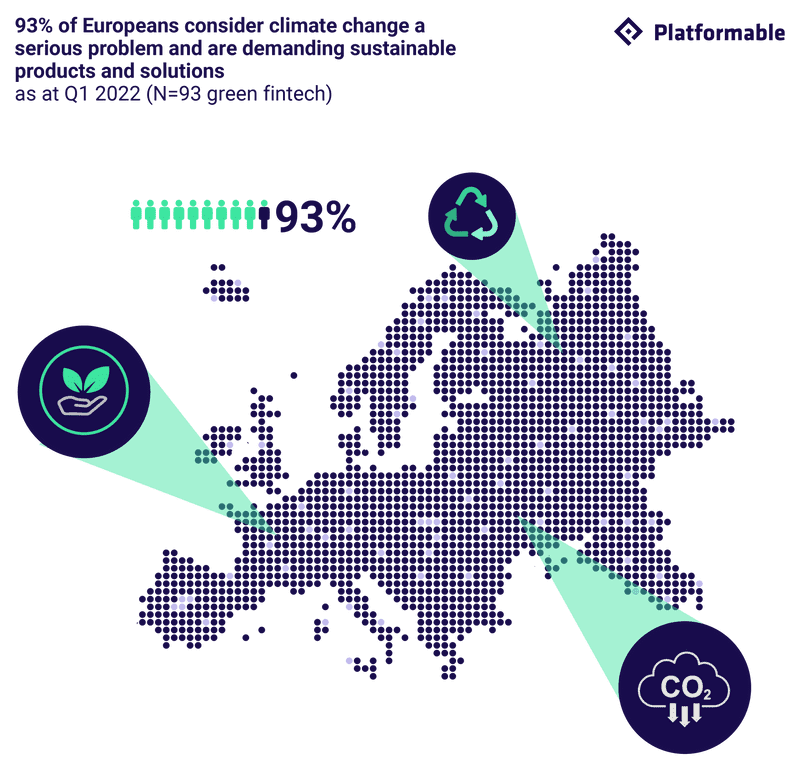

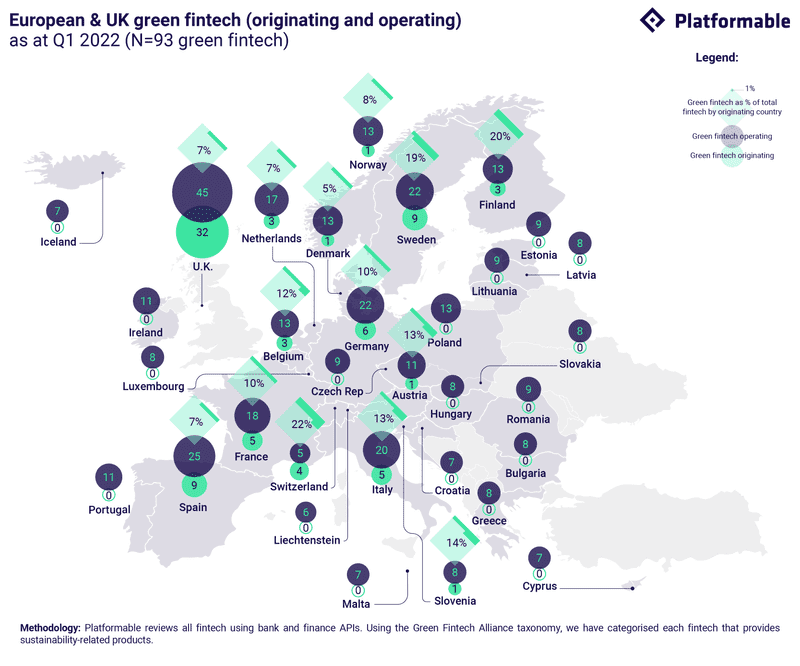

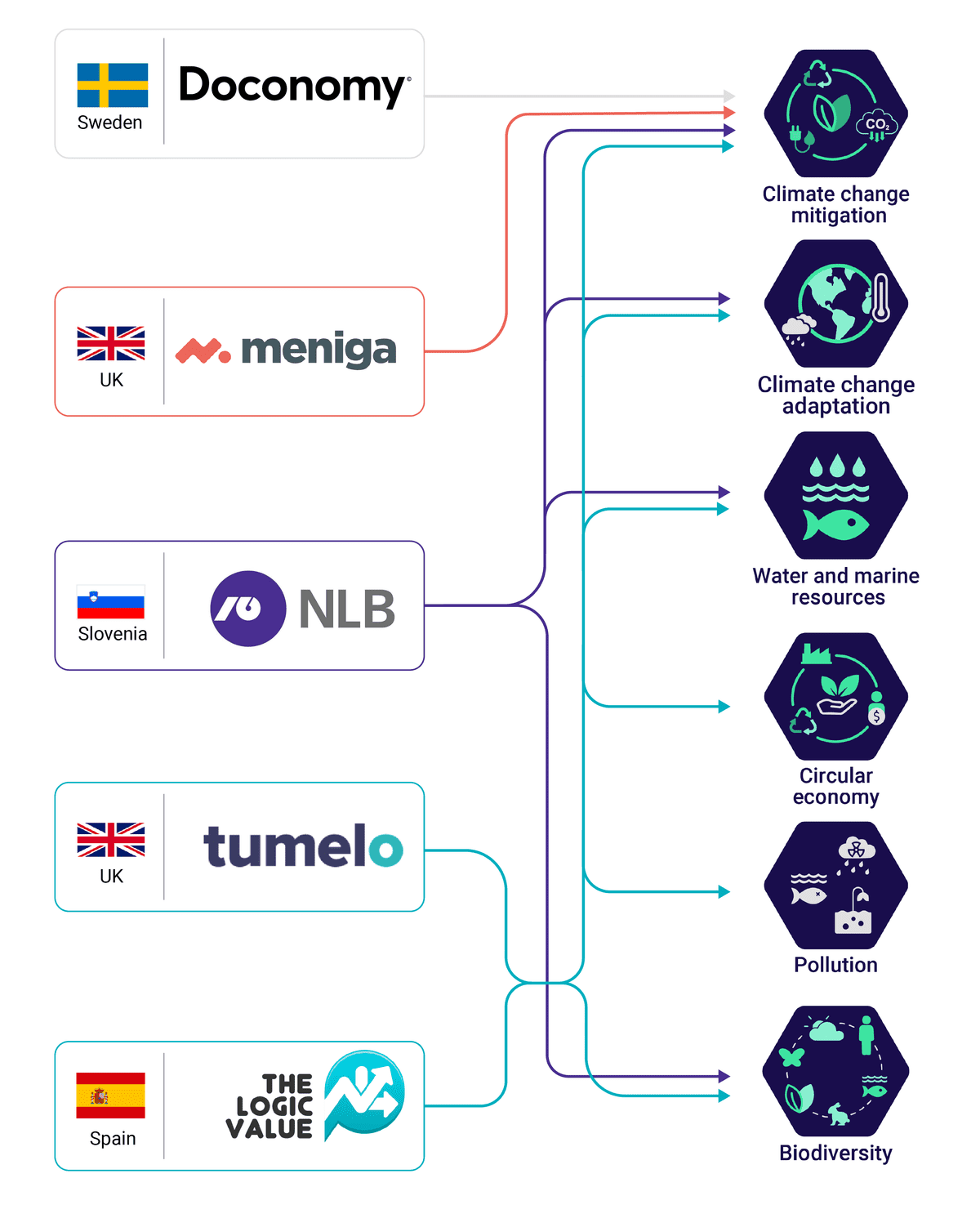

The majority of UK and European fintech offering sustainability products and services dedicate at least some of their offerings toward climate change mitigation. As part of Platformable's Q1 2022 Open Sustainability Trends report, Using Open Banking and Open Finance APIs to Build Green Fintech, we monitor the sustainability impact alignment of fintech products created using open banking APIs. To this end, we've taken a closer look at five European and UK fintech to explore the value their products are creating in sustainability markets.

Creating awareness through Impact-as-a-service API

Referred to as ‘Impact-as-a-Service’, Doconomy’s Transaction Impact API and the underlying Åland Index can be used to calculate the greenhouse gas and water use impact of digital financial transactions. One of the most mature carbon accounting calculators in the industry, it has been developed with Ålandsbanken and is an example of successful bank/fintech collaboration in developing API-enabled green fintech.

Doconomy’s carbon calculation service is made available on API marketplaces such as the Crosskey Open Banking Market.

Levering the wider open ecosystem for greater reach

Digital bank Belgium Banx is powered by the banking services of Belfius and the telecom company Proximus, and connects with Doconomy to offer GHG insights to end-users.

Helping banks launch green products

Customers are increasingly demanding sustainability from the products and services they use, and banking and finance are no exception. Personal finance and banking services provider Meniga and their carbon footprint solution enables banks to create appealing new green products in response. Some banks that are using the tool are one of the largest banks in Iceland, Íslandsbanki and Portuguese national financial group, Crédito Agrícola Group.

Making use of open banking infrastructure, the service enriches transformational data by adding a carbon footprint layer on personal financial transactions.

Empowering users to take action to reduce their carbon footprint

Beyond information, customers are offered options to compensate for the negative environmental impacts of their purchases and financial transactions.

Banks can surface their climate friendly product offerings such as savings, mortgage or investment products.

Carbon offsetting via certified programs is also an alternative, although the industry as a whole needs to exercise greater caution over offsets as the only or preferred action due their questionable potential to create long-term positive sustainability impacts.

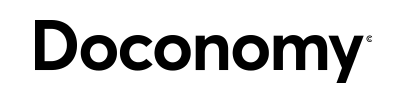

Responding to farmers’ challenges

NLB Group is the largest banking and financial group in Slovenia, providing a wide range of services and solutions in southeast Europe. Their offering, NLB Agro, is designed to help farmers modernise their operations and deal with the growing challenges in a climate changing world.

Farming is a very particular business model with its unique challenges: increasingly common extreme weather can wipe out yields and therefore profits, and many smaller farmers in particular are struggling with digitalisation. NLB Agro’s tailored financing and flexible credit and individualised advisory services is designed to respond to these challenges and helps farmers build business capacities required to succeed.

Making use of digital services

As the farming industry gets ready for a generation change, younger farmers are well positioned to make use of digital services. Other NLB services available for farmers include point-of-sale card services that allow customers to pay cashless and digitally, and leasing solutions for agricultural equipment, which removes some of the upfront costs associated with purchasing costly machinery.

It appears that farmers could make use of NLB’s financial services by connecting through FlikPay (operating as NLB Pay) to enable instant payments and cashless transactions.

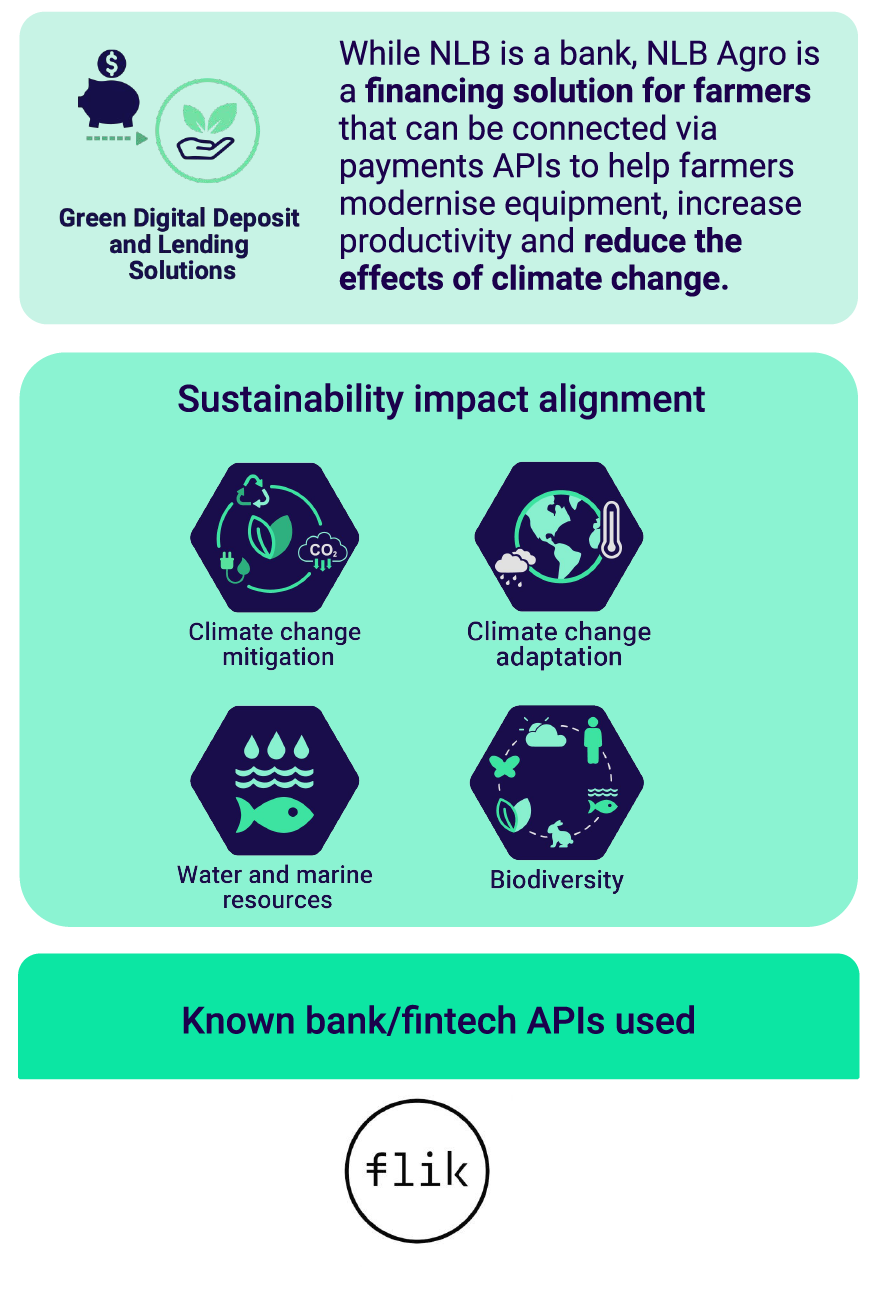

API-enabled transparency on how pensions and savings are invested

Almost two thirds of savers or pension holders want more transparency from financial service providers on environmental issues, but many are unaware of how their savings are invested. The UK founded company Tumelo addresses this by giving savers and investors visibility over what companies their savings are invested in, and allows them to vote on sustainability related decisions.

The fintech offers two API products, Transparency API and Voting API, which serve both the individual and enterprise target market via investment platforms and pension schemes. They partner with various UK pension providers, such as Aviva and the net zero pension provider Cushon.

Over 30,000 stakeholders have voted in corporate AMGs

The Transparency API shows a full breakdown of companies that a fund or portfolio is investing in. With that knowledge, end users can vote on ESG issues in Annual General Meetings of those companies via the Voting API. Over 30,000 votes has been enabled to date.

Using AI to assess climate metrics in risk management decisions

Founded in 2012, TheLogicValue provides B2B financial digitalisation solutions to enterprises, primarily banks and insurance companies. Participation in Bankia’s innovation program in 2017 accelerated its expansion beyond Spain.

TheLogicValue’s primary product offering is a virtual AI-based financial advisor solutions that enable banks and insurance companies to enhance their customer engagements. The fintech has also been partnering with Bankia to incorporate AI and climate metrics into its credit risk assessment toolings used by the bank’s risk department. Such solutions - so called ESG regulatory compliance - can also help integrate climate risk management in an enterprise’s supply chain oversight.

ESG regulatory compliance solution allows climate risk assessment for financial institutions

ESG data solutions incorporates the EU’s Sustainable Finance Disclosure Regulation (SFDR) and EU Taxonomy for sustainable activities and assesses whether a business complies with their reporting requirements.

- Solution A4C Risk allows automated control of investment s and regulatory information according to the EBA and EIOPA criteria.

- Solution A4C SFDR integrated with global data provider such as Refinitiv to enable investment funds, pension plans to meet its SFDR requirement.

Interested in learning more about sustainability in the open bank and open finance sectors?