Q1 2022 Open Banking Platforms: Four global examples

6 min read

Share this article

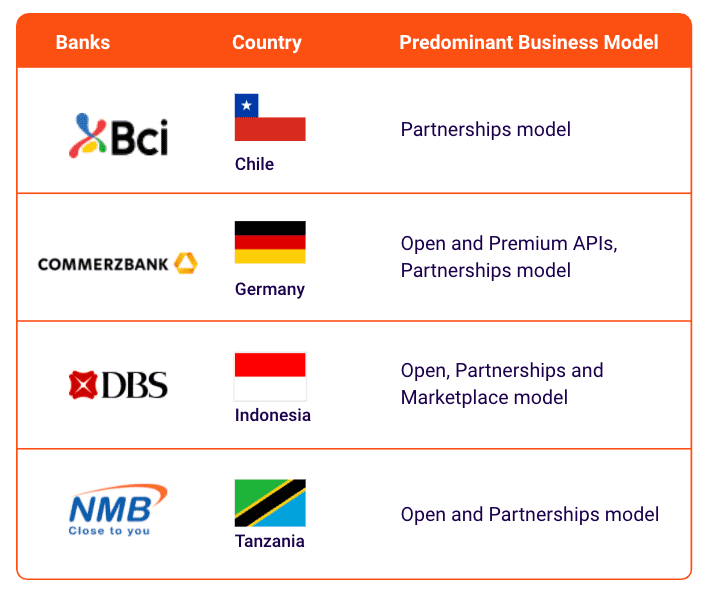

Open banking platforms have begun expanding their banking API business models. As part of Platformable's Q1 2022 Open Banking/Open Finance State of the Market Report, we monitor the transition to open banking economies, wherein bank services are available via APIs. Third parties can then use these APIs to add value to the market by creating new products and services. We took an in-depth look at four open banking platforms to examine the types of APIs they offer and their business models, according to our taxonomy.

BCI Chile: An industry-led market approach to making APIs available

API products by category as of Q4 2021 (N = 10)

BCI is the first API marketplace in Chile, offering both open APIs and a partnership program to third party providers.

Loan and data API product offerings

BCI offers a wide range of API products suitable for building applications targeting both individuals/households and businesses. In addition to account transaction APIs, the bank has opened credit, identification, and data functionalities to third party providers:

- A mortgage widget enables third parties to easily integrate BCI home loan APIs into their websites through a low-code integration.

- Economic Indicators APIs allow third parties and businesses to integrate BCI’s real-time economic indicators directly into their workflows and analytics systems.

Partner and acquisition platform business models

BCI offers a partnership program to third party providers. To build apps with BCI’s APIs as an “official BCI partner” a formal request for bank approval is required. Given that Chile does not have a regulated open banking environment, BCI’s partner onboarding process provides a funnel for the bank to independently review potential third party users.

BCI is also drawing on incubator and acquisition business models to expand its capabilities. They have recently acquired the e-commerce payment solution, Pago Facil to strengthen their payment platform and to expand into the e-commerce market.

To date, BCI has not published details on their fintech partnerships or on the products and services built using their APIs.

Commerzbank: Catering to both end-users and fintech partners’ needs

API products by category as of Q4 2021 (N = 10)

Commerzbank divides its API program into two streams–PSD2 and Premium–in order to enable new revenue opportunities and business models from their APIs.

API product roadmap announces regular releases

Commerzbank’s developer portal includes an API catalogue, guidelines, partner onboarding, and use case descriptions–all of which utilize best practices for developer experience (DX).

Forthcoming APIs are also outlined, giving third-party providers a roadmap to plan for the creation of new fintech products and services. Additionally, a range of Banking-as-a-Service APIs are available to corporate customers.

Customer and Home Loans Light APIs are the latest additions to the bank’s API catalogue. The Customer API helps streamline onboarding for authenticated customers, which removes the need for duplicated addresses from end-users. The Home Loans Light API allows third parties to offer end users an indicative interest rate based on their loan application details.

Leading sustainability use case development

Commerzbank promotes its open banking partners via a collaboration section in its developer portal.

One such partner, prepaid power supplier Energie Revolte, uses Commerzbank’s Corporate Payments API to offer an instant payment method to their energy customers. The API provides updates on payment notifications occurring nearly in real-time, enabling faster energy supply to their customers as prepaid energy payments are confirmed.

DBS: An exemplary embedded finance practice in Indonesia

API products by category as of Q4 2021 (N = 20)

DBS Indonesia embeds financial services into their clients’ systems, offering over 180 modular APIs that can be combined to meet various industry needs.

An API-as-a-product strategy…

DBS Indonesia has a clear API-as-a-product business model:

- The bank positions its APIs as digital financial services solutions–the DBS IDEAL RAPID–for corporate clients. Through these APIs, it embeds financial services directly into the clients’ systems.

- The product page is well organised and engaging, including a casebook and videos explaining specific use cases with real examples from API consumers.

- FAQs are also available to address key technical support requirements, though the focus remains on the business solutions of their API offerings, which includes informational APIs, transactional APIs, and workflow APIs.

…with a design thinking approach

Each casebook use case page is organised to include key information such as the client’s pain points, the solution enabled by the bank’s APIs, and the value/outcome to the client once the integration is in place. Additionally, a full workflow of each use case is provided.

The casebook also showcases the bank’s key capabilities in Southeast Asia: marketplace (agriculture with Halcyon), payment solutions (e-commerce and mobility with Bukalapak, Gojek), and banking reconciliation (with insurtech Singlife).

Of note, DBS APIs enable Indonesia’s leading online retail platform, Bukalapak, to automate payments to its merchants–most of which are small businesses. Bukalapak has a similar partnership with Standard Chartered as well, indicating an open ecosystem in the making.

NMB: Tanzania’s first open banking initiative by a leading incumbent

API products by category as of Q4 2021 (N = 1)

NMB Bank offers working capital and technical support to local startups through an approximate $0.5 million seed fund and a sandbox environment.

Sandbox created to attract fintech partners

NMB Bank has a strategic approach to open banking business models and fintech partnerships. It is the first leading incumbent to open a sandbox environment for local fintech and startup partners to test their APIs. The sandbox portal outlines a wide range of use cases that NMB Bank, traditionally a bank geared toward individuals and microenterprises, is looking to collaborate on with fintech. These use cases include deposit acceptance, payments, lending-related and credit reference services. Prior to the sandbox’s launch, NMB Bank partnered with Mastercard, Union Pay International, and Selcom for a number of innovative payment solutions.

Learning from international standards and DX best practices

Developer resources include SDKs and documentation aligned with key international open banking standards (Berlin Group, STET, and the Australian CDR standard) indicating the bank’s focus is on international developer experience best practices.

Interested in learning more about worldwide open banking/open finance regulatory trends? Check out Platformable’s quarterly Open Banking/Open Finance State of the Market Reports.