Q1 2022 Open Finance Trends: Home-grown fintech, focus on small and medium enterprises

7 min read

At Platformable, our core mission is to measure the value of open ecosystems in order to enable all stakeholders to participate and co-create their own value. APIs are central to such ecosystems, as they allow third-party providers to integrate open data into their applications, creating value and increasing customer options. Platformable's Q1 2022 Open Banking/Open Finance State of the Market Report monitors API-enabled fintech adoption worldwide. We study the APIs’ target markets, where they originated, and who benefits from them.

How we see open banking generating value for everyone

Demand-side characteristics include:

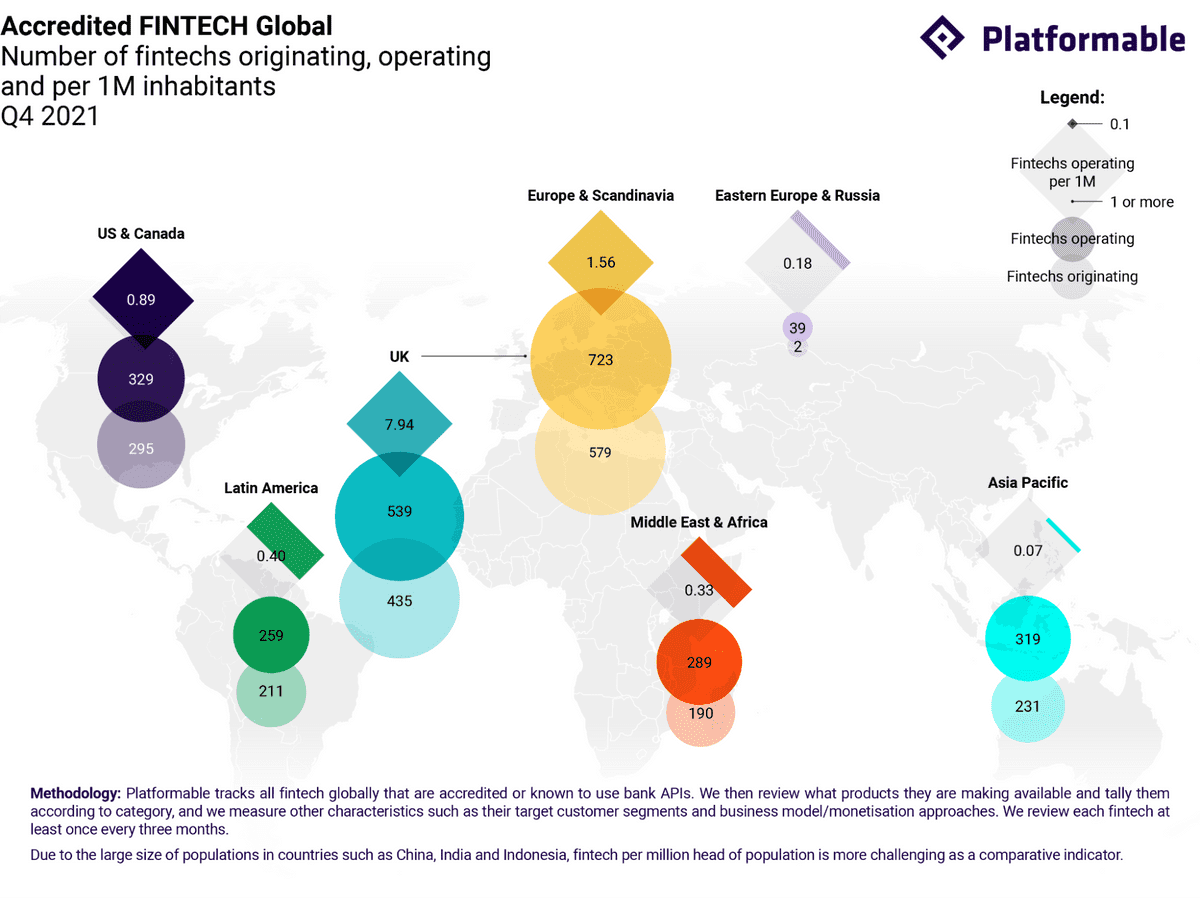

- Fintech: We currently track 1,943 fintech that make use of open banking APIs or that are fintech platforms in their own right.

- Aggregators: Of these 1,943, 95 are API aggregators specialising in harmonising fintech and bank APIs in order to speed up product development.

- Marketplaces: With the surge in embedded finance, it will be essential to start mapping how finance APIs are used in marketplaces.

- End Users: The bulk (38.8%) of fintech built on banking and finance APIs focus on the small and medium enterprise (SME) market.

- Indirect Beneficiaries: From a societal perspective, fintech could play a part in reducing exclusion, but to date, only 58% of fintech appear to have women in leadership positions and only 46% have diverse management teams.

API-enabled fintech is limited and often home-grown

Open banking platform availability has yet to translate into wider consumer choice. Locally originating fintech accounts for 80% of the market in the US, the UK, Europe, and Latin America. In the Middle East and Africa, local fintech accounts for 66% of the operating market and in the Asia Pacific region, it accounts for 72%.

The UK continues its lead with an average of 7.94 fintech operating per 1 million inhabitants; the highest percentage per population worldwide.

Additionally, there has been noticeable growth in the Asia Pacific region. Though the area hosts only 231 fintech originating locally (with 319 fintech in total currently operating in the region), it is a marked increase from the 281 fintech operating and 212 locally originating as of Q2 2021.

Due to the changing financial landscape in India digitalisation has increased, opening up new fintech opportunities. According to India’s Finance Minister, Nirmala Sitharaman, India’s fintech consumer adoption rate is 87%, the highest in the world. The majority of this adoption is focused on digital payments.

India has also announced their adherence to The UN’s Responsible Digital Payments principles, a set of best practices to make regulatory landscapes safer and more equitable for all, so we can expect continued growth in the region.

Over one-third of fintech built with open banking and open finance are payment solutions

Four of the top 10 fintech sub-categories are payment apps, which predominantly target SMEs worldwide.

The US and Europe host the largest number of Payment Back-End and Infrastructure, FX Services, and B2B Payment Service Providers. These meet the increasing needs of SMEs to streamline and reduce the associated costs of making and receiving payments to suppliers and from customers (an issue that has been additionally impacted by the ongoing COVID pandemic).

There are also a large number of Account Keeping and Budgeting and Account/API Aggregation fintech, which offer generic bookkeeping and financial management solutions to SMEs and individuals/households, reflecting the first wave of products able to be built with open banking APIs.

Other fintech products built with open banking and open finance APIs include Digital Banking, Card and Wallet Management, Consumer Lending and Credit Services, and Alternative Lending–many of which target individuals/households.

As we only measure API-enabled fintech built on open banking and open finance APIs, it is a smaller subset of the total fintech market. Open banking APIs in particular are also used as part of internal processes and automated workflows by enterprises and SMEs, which is not captured in the fintech taxonomy. In any case, there are plenty of opportunities to build more products that meet a vast range of end-user needs that are as yet untapped.

Payments infrastructure leads the API-enabled open banking/open finance ecosystem

Globally, Payment Back-End and Infrastructure remains the top fintech sub-category. While many of these fintech connect to open banking platforms–allowing seamless payments directly from bank accounts–they also reflect payments gateways offering themselves as open platforms for fintech to build upon, circumventing banks altogether. However, there are instances where payment providers have partnered with banks directly. Paycorp partners with eight top South African banks such as Nedbank, Standard Bank, and Absa to extend the bank’s brand at ATMs which allows customers to withdraw money directly from their bank accounts using Paycorp’s transaction processing software.

In addition to infrastructure, other payments sub-categories such as FX Services, B2B Payments, and Card and Wallet Management also feature in the top 10, making payments the most represented category overall.

Banking platforms continue to predominantly focus on business models that partner and incubate with fintech, keeping their relationships close. However, open banking could enable banks to generate revenue from API products by allowing fintech to build new end user-facing products. To date, only a small selection of banks are taking such an approach.

Consumers want more innovation from open banking and open finance

Digital readiness is a key factor in whether open banking and open finance will continue to grow. On the supply side, there needs to be performant, secure APIs provided by banks and fintech platforms, and fintech using these APIs to build solutions. On the demand side, there also needs to be consumer willingness to use solutions that directly connect with their bank accounts and an appetite for adopting fintech solutions. Digital readiness will require trust and understanding in the value of open banking, a willingness to use fintech apps, and the availability of fintech solutions that meet consumer needs.

Understanding of open banking

In a U.S. survey by Axway, 52% of respondents had not heard the term “open banking”. When the concept was discussed with them, survey respondents worried about issues surrounding constant monitoring of their financial activity (33%), losing control over access to their financial data (47%), and financial institutions using their data against them (27%).

Willingness to use fintech apps

A study by open banking middleware platform Temenos found that interest in digital financial services has evolved rapidly following COVID. They quote Michal Kissos Hertzog, chief executive of Pepper, an Israeli digital bank: “Overnight people became digital when it was supposed to take ten years. It doesn’t matter if you are Gen X or Gen Z—everyone became digital.”

In a study with 4,000 UK and US consumers, Plaid found that 88% of Americans and 86% of Britons used fintech in 2021, citing: “Usage jumped in every category, both in terms of the percentage of people’s money managed digitally—from 55% to 65% in the U.S., and 67% in the U.K.—and across the types of fintech tools used (payments, investing, and saving each surpassed 50% adoption in 2021).”

Demand for specific services

A study by Morning Consult with 17,401 adults across 14 countries found that Latin American and Spanish consumers, in particular, would like to see greater innovation in the types of financial services and products that are made available.

The bulk of API-enabled fintech target small and medium-sized enterprises

Fintech built using open banking and open finance APIs are predominantly targeting the SME (close to 40% of all products) and individual/household market (around one-third of all products). However, we see that the majority of these products are fairly generic and are not targeting sub-populations by designing specific features that meet the needs of end-users.

That is not always the case, of course. Products like Holded, founded in Spain and offering SMEs account-keeping integrations and business financial management tools, address specific market gaps by providing features that help businesses manage complicated country-specific tax invoicing regulations.

Positively, we are seeing some growth in the number of business operations and data/algorithms/analytics products being provided to support SMEs leverage financial data and fintech digital transformation in their businesses.

From an individual/households target market perspective, research like Bailey Kursar's Good Futures Project identifies financial product needs for women, which could be used by fintech to design specific products or to enhance current products with specific features. Beyond marketing exercises, we are seeing a limited range of fintech products specifically targeting women’s financial needs.

Interested in learning more about worldwide open banking/open finance regulatory trends? Check out Platformable’s quarterly Open Banking/Open Finance State of the Market Reports.