Open Banking Quarterly Trends Report Q2 2020: Fintech

6 min read

Share this article

Last updated: 19 August 2020

In Q2, we expand our look beyond Europe into the Asia-Pacific region. At present, our data collection model has been focused on reviewing accredited fintech in each region, that is, we rely on regulators who collect and share data openly on which fintech are registered to use open banking APIs. In other jurisdictions, there are no public registers available. Our analyst team is building alternative sources to widen our coverage of fintech using open banking APIs for Q3 and beyond.

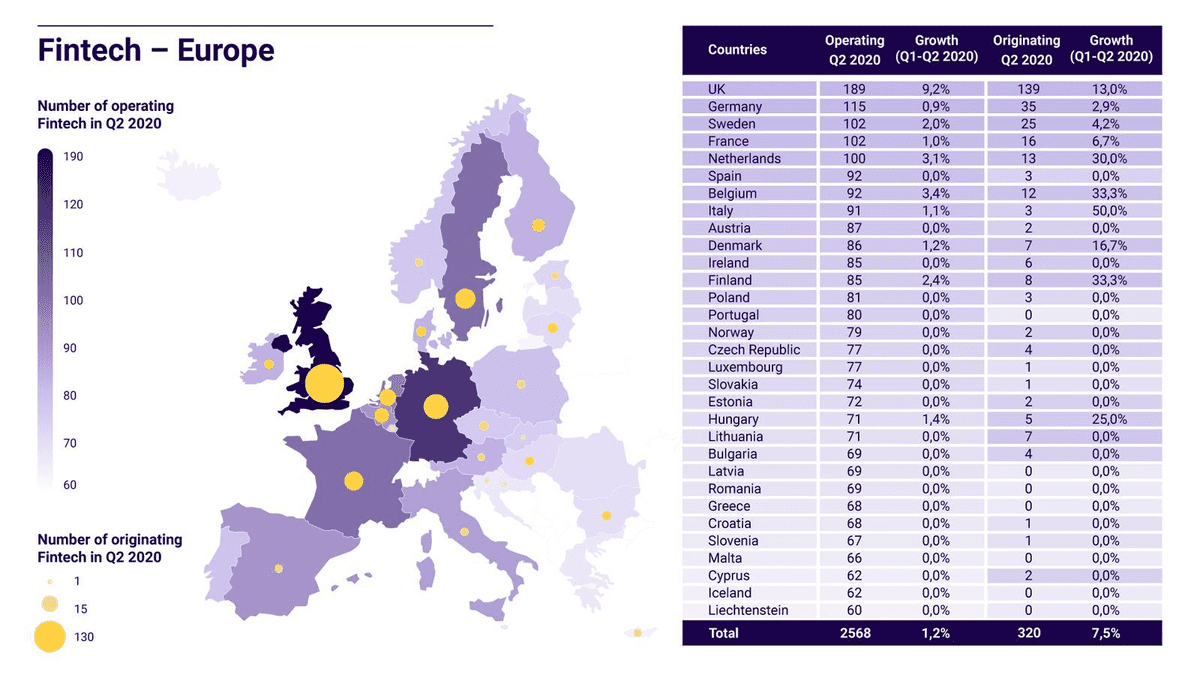

European & UK Fintech: 320 accredited providers (7.5% growth rate over Q1 2020)

There has been an increase in fintech getting accreditation to use open banking APIs in both the UK (9.2% growth over Q1) and Europe (13% growth over Q1), with a clear difference emerging between the regulatory environment of the UK, which has open API standards in the form of a template that all banks must use, and API regulatory standards in Europe, which has a list of characteristics banks must include in their individually-created APIs. UK is seeing a much larger number of fintech originating there (44% of all fintech accredited under banking API regulations) than Europe as a whole, but Europe is a much larger market. In Europe, fintech can passport their accreditation which allows them to operate in multiple jurisdictions at once. But from our discussions with fintech, many are unclear that they can do that. This has resulted in patchy distribution of fintech implementations that are not leveraging the European digital single market.

Jacques Pütz, CEO of LUXHUB, puts it well when he says that in the fintech world, startups are keen to focus on the US because they see it as an 330 million population-size consumer market, whereas in Europe they count an individual country and see it as that size: 83 million population for Germany or 67 million population for France. But if there is accredited fintech and standardised banking APIs, fintech (and the banks they partner with) could see Europe’s consumer market population size as 740 million, the whole of Europe.

In Europe, fintech is too often seen as a threat instead of an opportunity

In Europe, there are still instances of banks working as a bloc to reduce fintech opportunity. This reflects the challenges that banks have in changing their cultural chip to embrace a platform mindset. But setting up these blockages is disconcerting and suggests a short-term view of the digital economy. In truth, banks have much more to fear from the tech giants who are coming for them. Tech giants like Amazon may be partnering with some global banks, such as Goldman Sachs, now, but a review of how Amazon has behaved in other markets it has entered suggests that their “winner takes all” approach to platforms means that ecosystem partners today are likely to be squeezed out tomorrow. Looking at their ecommerce business, Amazon started by enlisting retailers and product suppliers and encouraging them into partnerships so that Amazon could reach new customers. Once enmeshed on their platform, however, retailers and product creators have complained of bullying and competitive tactics that have forced many to accept Amazon’s terms. Amazon also has access to data on the entire sales funnel occurring on their platform, which has led them to build products in direct competition with their ecosystem partners.

This is the real threat for banks, and fintech could actually be their saviour and help them build resilience against that risk. By creating their own fintech platforms, banks could extend their reach and strengthen customer stickiness by offering a suite of digital financial products that protect themselves as Amazon, Google, Microsoft and Facebook enter the financial services market.

Instead, some banks are still setting up obstacles against third party providers, that is, fintech. On 4 June, the European Banking Authority released an Opinion on Obstacles to Strong Customer Authentication and Common and Secure Communication. The opinion found the need to stipulate that, for example, if a bank creates a workflow in which an end user would need to re-open a fintech app in the middle of a consent authorisation workflow, that would constitute an additional level of friction, or obstacle for the fintech. The EBA had to clarify seven areas where banks in some countries had introduced additional steps that could be considered as introducing friction. For example, in Belgium, which has a high level of fintech originating in the country, obstacles include 90-day re-authorisation of fintech’s permission to link their customer’s data to an app. In addition, end users need to buy a specific card reader technology to connect their bank records to their preferred fintech app.

At Platformable, we are testing the best way to share our open banking quarterly trends data with you. For this Trends Report, we are releasing Q2 data each day for the next two weeks (4-14 August) directly on our website. We still encourage you to sign up for additional content and to be reminded when our quarterly trends reports are available. This quarter, subscribers will receive a keynote paper from Platformable's founder, Mark Boyd, who presented findings on open banking at apidays New York on 28 July 2020.

Asia-Pacific Fintech: 161 accredited providers in 4 markets

Outside of Europe and the UK, accredited registers of fintech using banking APIs exist in Hong Kong, Singapore, New Zealand and Bahrain. Similar to Europe and the UK, enterprise collaboration and workflow software constitutes the bulk of fintech products and services currently being brought to market.

High numbers of fintech providers in Singapore reflect the legacy nature of Singapore's open banking system, but are also an artefact of regulation that requires payments providers to be accredited in particular. The vast bulk of these accredited fintech are payments services. Other fintech and businesses that make use of open banking in Singapore are not necessarily reflected in these figures.