Q3 2021: Open Banking/Open Finance Needs to Focus on Unmet Customer Segments

18 min read

Open banking and open finance are recreating the world's global digital infrastructure for financial services.

Globally, there are open banking and open finance regulations in place in 63 countries. In particular, these regulations are moving towards mandating that banks make certain functionalities available via API. Regulations may stipulate, for example, that banks need to open up account information and payments services infrastructure to allow third parties to build new products and services.

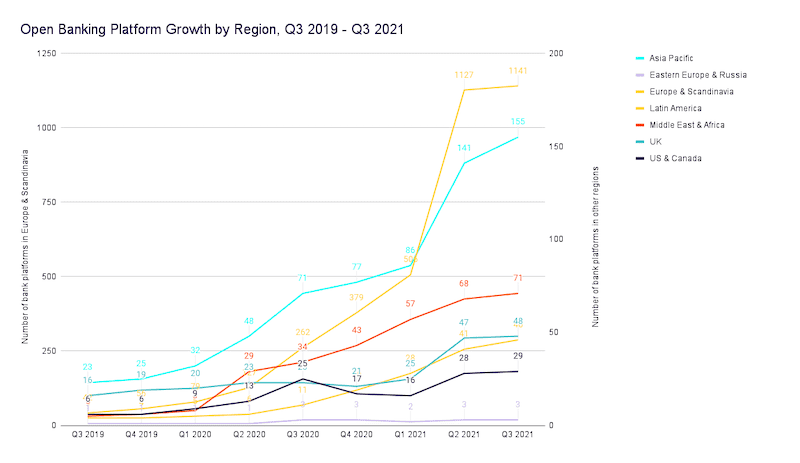

Key regions where regulations are driving activity include Brazil, which is inspiring other countries in Latin America to act. Recently we have seen some movement in the United States, traditionally a country that has been more willing to allow market-driven collaborations to be the driving force for opening banking and fintech APIs, with an Executive Order now in place from the White House to insist that banks make it easy for customers to switch accounts to alternative banks with complete data potability rights. Overall, banking demonstrates that regulations enable innovation: In the past year, bank platforms have grown 489%, the majority in Europe because of the Second Payment Services Directive regulatory context.

Globally, in all regions, bank platforms and bank API products are growing. In Asia Pacific, the Monetary Authority of Singapore was one of the first to realise the value of open APIs: they released a guide for banks that spelt out the opportunities and they created an index of use cases with a wide range of granular level functional APIs. Initially, many banks in Asia Pacific followed that model, building essentially microservice-level APIs. Over the end of 2020 and at the start of 2021, however, we started to see some consolidation from Asia Pacific banks where these APIs were then bundled together to create more capabilities-driven APIs that included multiple functionalities, so over the first two quarters of this year, it appears as if there was a dip in the API products available in Asia Pacific, which can be attributed to this repackaging of API functionalities.

Overwhelmingly, however, the majority of banks are still only opening APIs that they are mandated to do so. In the above graph, the light purple shaded bars represent API products that banks are required to make available (that is, account information and payments, but in some regions also bank product and ATM location APIs). The gold bars represent the true innovation: areas where banks have identified an API product opportunity and have decided to open APIs to third parties on their own volition.

Identity is clearly seen as an opportunity for many banks (443 bank products), based on a bank’s positioning as a trusted player that can verify a business or individual identity well. In 2021, we have seen trading APIs increase (from 96 products to 240 products by start of Q3 2021).

But what does creating value in an open banking/open finance ecosystem really mean? In the above diagram, from the left hand side, governments tell regulators to set rules in place for open banking. Banks have to follow those rules and make APIs available. And fintech platforms, like payments providers, are also making their functionalities available via APIs. They may use internal standards and API and data governance processes to ensure consistency and uniformity, and industry-based standards to be able to develop those APIs whether an API specification standard (like OpenAPI) should be used, whether they are API-specific standards, or more general standards that consistently describe how currency and dates should be formatted.

The APIs created are then used or consumed by marketplaces, aggregators, and fintech. So they're the ones who are using the APIs. And they may be either sold directly to end users or via distribution channels.

The quality and the speed with which they can use those APIs will be mediated by some value enablers. So the quality of the developer experience and the level of security of the APIs will determine how much these API consumers can use an API tool. Providers play a big role in enabling the sort of tooling that increases the value that can be pushed through an API. And they also support the banks to be able to deliver security and so on. And then out of that, we've identified five end user segments.

The underserved, individuals and households, sole traders, small and medium enterprise (SME) businesses and enterprises are meant to all enjoy increased financial health and well-being benefits from using these new fintech products or embedded finance products that are built on the bank APIs. And then out of all of this, there are also indirect beneficiaries: the society benefits from ease of use (everyone doesn't have to wait in queues at the banks anymore and people have more consumer choice); the economy benefits (because there are these new players that are growing that are able to contribute taxes but are also employing local people) and the environment benefits (because digital infrastructure resource use should be optimised so there's less waste and less costs, but also because open banking/open finance APIs are being used to create new environmentally friendly products like carbon calculators and so on). Fintech and align with environmental and sustainability goals as well.

So to evaluate how well open banking and open finance ecosystems are operating as our new global digital services infrastructure, we need to ask: Who is being offered open banking and open finance related products?

In Q3 2021, we tracked 1201 fintech that we know are specifically using bank or open finance APIs. The majority (54.6%) target SME businesses, followed by individuals and households at 38.6%, and a small number of self-employed (1.9%) and enterprises (4.5%).

In Q3 2020, when I keynoted at the apidays London conference a year ago, I finished my presentation by asking:

I gave two possible avenues of the future that we were starting to see. The first was Monzo, which at the time had a new premium credit card that's made of metal. So the idea of product differentiation was really just a status symbol for wealth or luxury indicator rather than anything that truly has value (Monzo does slightly more than the bare minimum for enabling APIs: they have the required payments and accounts APIs, and a confirmation of funds APIs, but they often leave developer form questions unanswered, and developers need to test the API against their own Monzo account).

But then the other opportunity is to go down looking at the individual use cases that could be enabled by open banking APIs. Last year, I showed the Open Banking Implementation Entity's suggestions of a whole range of use cases. For example, they proposed a solution for leveraging rental financial data. This would enable renters to demonstrate and build their credit scores by showing that they're regularly paying their monthly rent, for example.

So, a year later, which one of these two avenues was being developed?

New trends in open banking/open finance

Trend 1: Banks using their API infrastructure to open newly branded digital banks

Many banks still avoid digital business models where they share customers and revenue with external providers. Instead, as they’ve digitised. Using their API-enabled infrastructure, they’ve created their own digital banks. Open Bank from Santander, Marcus from Goldman Sachs, Cake? In Vietnam (check). These banks are reskinning their brand for audiences who weren't interested in their traditional offerings.

In banking advertisements, you can do your own mini-version of a type of Bechdel test. If you look at bank advertising globally, the vast majority of images of bank customers are men. Maybe there is a woman holding a baby if it is about a family account product, but predominantly banks target advertising by showing men in boardrooms (business finances), men doing sports or out at night (their personal finances are taken care of), and so on.

But with digital banks, banks are beginning to target new audiences; women, or “younger generations” (Openbank's website features a woman smiling presumably at her investment portfolio while Marcus turns ‘money’ into a verb, a common lexicon amongst ‘younger’ generations - but you can also see the bank's reluctance to be too easygoing: they trademarked the slogan!). So banks have taken the product-market fit and user-centred design approaches and applied them to non-traditional customer segments such as women, generation Z, those who are app independent and happy to just do their own finances, freelancers, travellers: all financially independent segments who don't necessarily have loyalty to any one bank brand.

This trend can also be seen in the types of business models banks are using. Based on our business model taxonomy, we see that the vast majority of banks are either just opening the APIs they have to, or are creating incubators or partner APIs that are only available to APIs with a close connection to the bank, for example, for fintech that are not building directly competitive products. (There are some frontier banks that are trying to move into the banking-as-a-service and marketplace business models, and some that have started releasing premium/pay-to-use APIs, but it is not common).

The alternative: open API products for new markets

KBC in Belgium are a good example of a bank taking a more direct API business model route.

KBC have diversified their APIs and are focusing on particular segments. For example, they have both a green energy loan and a bicycle insurance loan API product. Sometimes, when a bank offers an API loan product, it is done using a revenue share model where the business that is sending the new loan customer to the bank will get some revenue back from a commission payment for sending that new customer as part of that customer acquisition.

But KBC don't need to do that because they can demonstrate to those retailers who are using these loan API products that the merchants will increase their sales by 20% if the customers can access credit at the point of sale. In this case, KBC aren’t paying anything for loan customer acquisition (beyond the costs associated with offering and maintaining their API) and they have pushed the integration costs onto the retailer who has to make use of the API themselves.

Where I believe KBC could improve is by having a marketplace showing which retailers use their APIs, as a kind of co-marketing offering that helps support those in their API ecosystem to grow. KBC does list examples on their developer portal (which aren’t linked), but they could surface those retailers on their customer facing website, and provide click-throughs. They could even market it as doing their part to support customers to transition to energy efficiency solutions. That would also help those retailers with search engine optimisation more generally which could also increase their viability and new customer referrals back to KBC.

Trend 2: Buy Now Pay Later

After API aggregation platforms (which when measured by investment are the big winners so-far in open banking ecosystems), is Buy Now Pay Later (BNPL) really the killer use case for embedded finance? 2021 seems to think so.

But we need to watch carefully how this impacts on the open banking/open finance ecosystems in 2022. Will we see debt collection as the next big use case as a result of oversupply of BNPL? Or will we see new financial literacy features that caution against BNPL if the repayments are higher than the customer’s average monthly incomes?

The alternative: measure impacts in 2022

Already in the UK, Citizens Advice is noting that there are challenges with BNPL. There are worries that regulation might not be able to protect consumers: we will be watching what new regulations are introduced to protect consumers. In markets like Australia and the United States, debt collection practises are incredibly predatory, allowing debt buyers to immediately increase interest rates, sometimes doubling the debt consumers have to pay overnight. up for consultation about what sort of level of oversight buying our pay later.

So are we setting up open banking and open finance so that after API aggregation, and BNPL, the next big market is going to be debt collection? The importance of offerings like Platformable’s comprehensive view of the open banking/open finance ecosystem, where we have developed a model that identifies how value flows, defined the stakeholders, and established metrics to measure to which stakeholders that value flows, will be essential for regulators and anyone interested in ensuring that open banking/open finance enables global financial digital infrastructures that benefit for all and allow everyone’s participation.

Trend 3: Wealth management fintech

Using open banking/open finance APIs to create wealth management apps has crept up as an emerging trend across 2021. This has been partly enabled by the bank’s increasing trading APIs available.

The alternative: moving from embedded finance to enabled finance

Embedded finance brings solutions, via open banking and open finance APIs, bring financial services to the consumer at the point of sale and at the point of engagement. Theoretically, these embedded finance offerings should lead us to enabled finance: where we are all enabled to:

- Increase financial literacy

- Make use of greater options in the solutions and providers we choose

- Improve financial health, and

- Contribute to solutions that benefit the society, economy and environment.

How do we use open banking and open finance to support truly enabled finance?

Solution 1: Data informed thinking

As the BNPL case demonstrated, we need to map open ecosystems to identify gaps and opportunities. Looking at our analysis, banks aren't providing sufficient developer resources, for example (see our Quarterly Trends reports for more data on DX scores of banks). So that could be a competitive advantage for some providers. Given the opportunities with embedded finance, there are also opportunities for API tool providers and consultants to facilitate integration with embedded financial products from within their toolstack. We see a little of this with API management providers offering specific financial services: Axway and WSO2 have specific open banking platform offerings and Gravitee has recently integrated FAPI accreditation into their platform. We expect to see more API management providers diversify, and for API aggregation platforms to offer API management services in 2022. But other API tools providers can also make it easy for any SaaS to incorporate embedded finance solutions into their apps.

Solution 2. Person-centred design and product-market fit

The wealth management use case demonstrated that fintech are able to think about specific target market segments. And digital banks are definitely doing this by repackaging their offerings to appeal to underserved markets. But overall, we don’t see this as a key strategy from fintech who just want to build a solution that meets all needs and become the next Klarna as quickly as possible.

Some of the underserved target segments we are seeing include:

Women owned businesses. Last year, at apidays London, I talked about how Snag Tights went to their customer base because there was no cash flow optimization solution available that met their needs. There were no loans, there was no financing available for a business that had increased sales every year for several years to a regular turnover of USD 2.5 Million and was increasing their market share in a global market that was with an estimated worth of USD42 Billion at the time. Instead, they had to rely on an interest-free loan approach, not dissimilar to the way Starbucks offers loyalty cards as mechanism to raise large sums of money from their customers (as noted by Simon Torrance noted in his keynote at apidays London 2021), to be paid back at some future date if the Starbucks card gets used for purchases. Snag Tights went to their customer base after there were no fintech products available and asked customers to buy two pairs of tights: one to be sent now, and the other in November after their finances were expected to be back on track after the immediate downturn from COVID-19. They raised USD2 million in 5 days, met all of their agreements with customers and ensured they had a pool of investment dollars to weather future challenges.

Why wasn't fintech looking at women owned businesses which are actually greater revenue generators and more stable than male owned businesses as a proportion? The week before i presented at apidays London in 2021, this argument again was borne out: another women’s undergarment product, Spanks, also owned by a woman, was valued at $1.2 Billion.

Women. Research like Bailey Kursar's Good Futures Project have been undertaken to identify financial product needs from literally half the global population. Beyond branding exercises like those used by digital banks and discussed above, we are seeing a limited range of fintech products specifically targeting women’s financial needs.

Migrants. The global remittances and payments infrastructure was predominantly built to meet the needs of migrants sending money internationally. Today that is a market worth X where Y is transferred globally. This demonstrates the viability of migrants as a market segment that could benefit from other financial services. For this market, we aren’t even really seeing the branding being done for women. They are a completely invisible target market segment, yet have proven their ability to make regular payments and support the growth of digital financial services infrastructure. Where are all of the other fintech products for migrants? To manage investments and property, invest for their children and parents, or save for specific travel?

Renters. One of the examples given by the UK’s Open Banking Implementation Entity that I referenced earlier and in my keynote from apidays London in 2020 focused on the financial needs of renters. Now we are seeing some solutions, like Jetty which offers three financial products in one for renters and property managers. Renters can build their credit history, use rental data to start building a deposit for moving expenses, and can buy rental insurance in the one app. Ideally, you'd see these kinds of fintech embedded into real estate management websites or on sites where you can actually look for housing to rent.

Sex workers. In 2021, the site OnlyFans sought to change their terms to prevent sex workers from sharing explicit adult content on the site, due to the imposition of bank and payment providers threatening to refuse processing payments, even though there are no governing regulations that define why consensual adult content material should be controlled. Our focus on the OnlyFans changes earlier in the year highlighted the potential inequalities and marginalisation that can occur if banks and payment providers seek to become the deciding authority over who can participate in open banking and open finance ecosystems. But we also highlighted the size of the market (USD2 Billion in 2021 alone) and from a quick look, there seem to be a limited number of fintech products aimed at integrating with OnlyFans account owners. With the growth of the “creator economy”, lessons learned with this market can be applied to a broader market of Patreon and other marketplaces.

Be like RuPaul’s Drag Race

To end my keynote, I used the tongue-in-cheek example of RuPaul’s Drag Race, which really is an excellent study in business management and product and marketing success. Taking a niche segment which often faced socio-economic and societal discrimination, RuPaul Charles built a global market virtually from scratch withTV franchises in the US, Italy, Spain, Canada, UK, and Australia, top-selling singles, a streaming service, global and Las Vegas-based shows, toys, games, clothing, wigs, clothing, shows and cosmetics associations, and a whole range of other products. While data on the value of the market overall is difficult to find (again, a sign of how much this market is still ignored), Ru Paul's personal wealth is conservatively estimated at USD6+ Million.

Now you can even see fintech and other digital providers seeking to leverage the interest in this market segment:

- John Lewis insurance in the UK created an advertisement for home insurance based on a young boy unleashing his inner “Stevie Nicks” in drag play

- Klarna’s home page targets a Generation Xers who could easily be a contestant on the show

- Zalando hosts content featuring women and drag queens discussing show choices

- And non-fintech products like DuoLingo are integrating phrases from the show into their lesson plans.

Open banking and open finance ecosystems are really just beginning and globally, markets like the US, Canada and Israel are only just opening up. Other markets like Brazil opened this year and are making sizable moves forward in a short amount of time.

There are lots of opportunities for fintech products to build engaging, interactive, useful products, but to date we aren’t seeing that translate into real offerings for end users, whether that be individuals, SMEs or large enterprises. One reason why this transaction isn’t growing substantially is because fintech aren’t focusing on market segments that were already left behind by traditional banking. They are not making new digital financial services available that meet target segment needs. Instead, they seem to be replicating the bank approach, but trying to move faster with generic digital offerings.

At Platformable, we track the open banking and open finance ecosystem and create bespoke research that combines our data with business market needs such as go to market strategies and target segment exploration. We run workshops on product ideation, architecture choices, and API product monetization. Book a meeting with me to discuss how we can support your goals in 2022: