Q1 2022 Open Finance Platforms: Data standardisation and improved financial outcomes

5 min read

Share this article

There has been a noticeable increase in data standardisation and accreditation under open finance regulations. As part of Platformable's Q1 2022 Open Banking/Open Finance State of the Market Report, we monitor fintech worldwide that are accredited in various markets to use open banking APIs. In the case of unregulated markets, we look at fintech that are part of industry-led standards bodies such as the Financial Data Exchange to measure the fintech’s level of involvement in open banking. To this end, we’ve taken a closer look at four fintech across the globe to understand the value they’re creating for local and international markets.

Nordigen’s banking API connects to over 2,000 European banks across 31 countries.

Open Banking Data Standardisation

Nordigen Premium, a suite of six new products, was released in December 2021. The products–Verification, Scoring, Categorisation, Patterns, Cleaning, and Enrichment–allow users to clean and structure their data, while also pinpointing specific account owner details. Important merchant information like name, website, and logo are organized in a readable manner for the end-user.

Providers like ISD FENIQS are simplifying access to Nordiegn’s APIs by creating low-code connectors, integrated with app development platform OutSystems, to increase use within new fintech apps.

European Startup Support

Nordigen launched Nordigen for Startups, a program granting European startups affordable access to open banking technology. Nordigen’s Premium Services are offered for free as part of the program, in addition to enabling access to over 1,000 European open banking APIs. The Premium Services provide data insights valued at €10,000 that eligible startups can access for a year.

Increased accessibility to open banking APIs eases the barrier of entry for European startups wishing to launch third party software, which in turn gives consumers more open banking options.

Quanto supports companies to draw on open banking data and services to improve financial decisions.

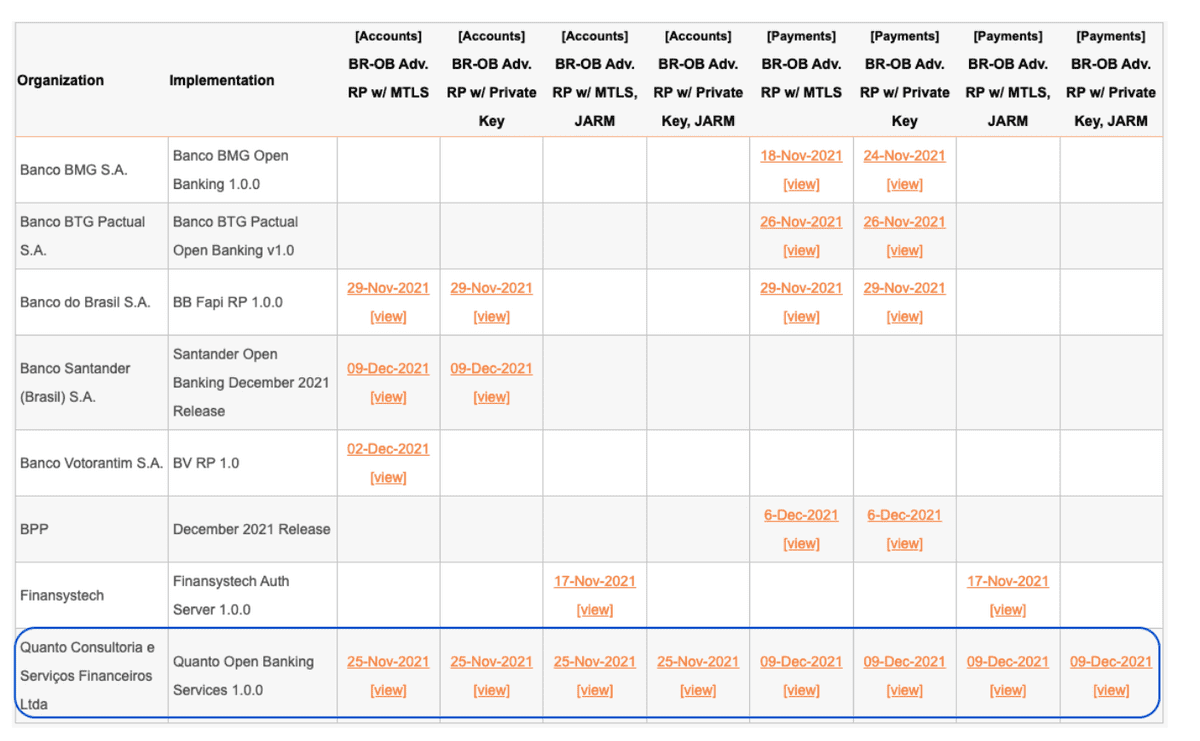

Widespread accreditation under Brazil’s open finance regulations

Under Brazil’s open banking regulations, banks and fintech must achieve accreditation* for each functionality they wish to either expose as APIs (predominantly for banks) or to consume as third parties (predominantly for fintech platforms).

To date, Quanto has achieved the maximum available 8 accreditations, enabling them to offer extended workflows to companies that want to automate and extend their financial information and decision-making workflows.

* Platformable also uses this data to quantify banking platforms in our dataset, however, there is a lag between banks achieving accreditation and making APIs available, and we only add the banks when their APIs or developer portal is published.

Increased API calls show potential use cases

Quanto analyses a range of market indicators and internal data to work with their customers to identify new opportunities.

They shared one example where open banking APIs allowed a company to improve their credit approval rate. Using open banking APIs, the company was able to demonstrate its transaction history, cash flow, return on investment and so on, to increase its credit approval rate by 28%.

Pinwheel is a payroll connectivity API, used by some of the largest neobanks and fintech in the United States.

$50 million raised in Series B funding round

Payroll connectivity API provider, Pinwheel, has gained traction in the industry due to its focus on an “income layer” of data that extends beyond salaried payroll to include hourly clock-ins. The varied income options available increase accessibility to the rising number of gig-economy workers who are paid on an hourly basis.

By creating an income verification and deposit switching API infrastructure, Pinwheel is enabling digital financial services to complete user journeys seamlessly and at pace.

Improved financial outcomes for credit damaged individuals

Pinwheel’s APIs cover over 1,400 payroll platforms, from top 100 employers to gig platforms, government employees, and those accessing unemployment benefits. They aim to increase lending opportunities for credit damaged and credit invisible individuals who have traditionally been locked out of such opportunities.

Payroll data is invaluable for assessing the income stability of those who would be good candidates for loans, yet are unable to depend solely on their credit scores for access to affordable financial products.

FinScore was the Philippines’ fastest growing alternative credit platform in 2021

Credit access expanded across the Philippines

SB Finance, a strategic partnership between the Philippines’ Security Bank Corporation and Thailand’s Bank of Ayudhya (Krungsri), has partnered with FinScore to expand banking opportunities across the Philippines. Using FinScore’s telco data scoring system, SB Finance can predict potential borrowers’ creditworthiness and assess their ability to avail themselves of the company’s loan offerings.

FinScore’s use of alternative data in predicting creditworthiness increases loan availability to borrowers who lack a solid financial history.

Digital footprints offer alternative credit scoring data

Many Filipino banks are unable to process borrowers’ loans due to the use of fraudulent identities and a lack of credit history from the borrowers. FinScore’s social media lookup tool, FindSocial, combats both issues by utilising social media data as an alternative to traditional credit scoring methods.

The digital footprints borrowers leave in the form of their social media presence helps banking institutions quickly verify their existence. Using digital footprints to confirm identity and access borrowers’ data opens unbanked and underbanked populations to lending opportunities they have traditionally been prevented from accessing with traditional credit scoring methods.

Interested in learning more about worldwide open banking/open finance regulatory trends? Check out Platformable’s quarterly Open Banking/Open Finance State of the Market Reports.