Q1 2022 Open Banking Trends: 175% annual growth rate, regulations move to data sharing

9 min read

Share this article

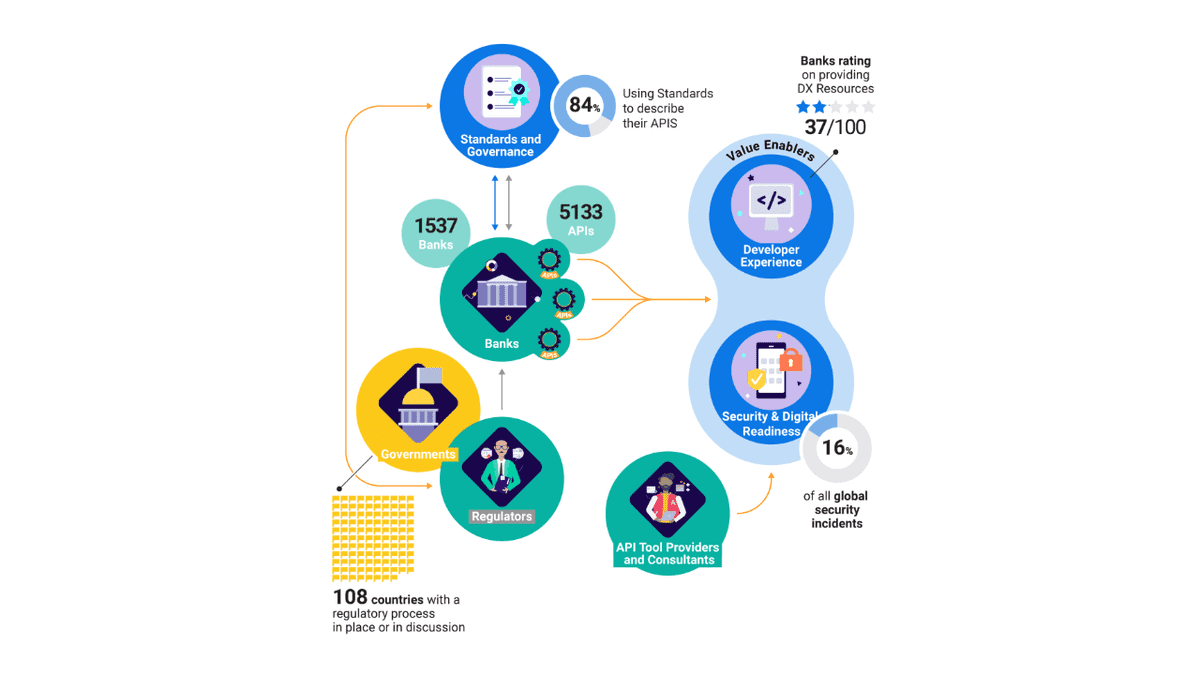

At Platformable, we believe that regulations are one of the key enablers in an open banking ecosystem. Regulations allow new market entrants, safeguard citizen finances, and encourage financial inclusion. Though specific open banking and open finance regulatory goals differ across countries, many aim to enable interoperability and enhance competition. They find that in doing so, the financial health and wellbeing of individuals and businesses are expected to improve. Platformable's Q1 2022 Open Banking/Open Finance State of the Market Report describes current timelines and progress on the adoption of regulations worldwide.

Open banking is unfolding at an annual growth rate of 175%

Supply-side open banking characteristics include:

- Regulations: We have identified 108 countries where open banking regulations have been introduced or are under discussion. At present, 59 of those are in implementation stages or under consultative review.

- Standards: Globally, 84% of bank platforms are using the OpenAPI Specification standard to describe their APIs. The standard helps potential API consumers more readily understand the bank APIs, which in turn facilitates rapid adoption by third parties.

- Availability: By the end of Q4 2021, we counted 1,537 banking platforms that make APIs available, equating to an annual growth rate of 175%. Collectively, these bank platforms make 4,831 open banking API products available, up from 3,496 at the end of Q4 2020.

- Ease of use: Despite the increasing numbers, banks are not making it easy for API consumers to use their APIs. Globally, on average they rate at 37/100 for providing DX resources.

- Security risks: In Q4, there were 4 security incidents involving banks and fintech, representing 16% of all industry-related security breaches.

Worldwide, open banking regulations evolve towards open finance and data sharing

Beyond open banking, Europe and the UK have mapped out their next steps to expand open finance via the UK Smart Data Initiatives and the European Commission Digital Finance Strategy. These initiatives seek to foster a coherent and coordinated regulatory approach to data sharing within and across sectors. The European Commission has requested input from the European Banking Authority to start a PSD2 review, while the UK has closed public consultation on a framework to regulate the buy-now-pay-later market.

North America is gathering momentum as well. In Q4 2021, the Consumer Financial Protection Bureau held a public consultation on consumers’ data held by big tech payment platforms in the US. In Canada, the results of the second review of open banking were also released.

Regulations across the Asia Pacific region have leapfrogged over open banking to open finance and open everything. Some of these advances include:

- The official launch of the Open Finance framework in the Philippines.

- An account aggregation framework for financial data sharing was launched in India. They’re also looking to link their instant payment system UPI with Singapore’s Paynow.

- The continuation of Australia’s data-sharing framework rollout, with a focus on the energy sector via the recently published Consumer Data Right Amendment Rules (No.2).

In Latin America, Brazil’s approach to open banking and open finance are causing ripples across the region (and worldwide). After launching the last phase of their open banking framework, participant institutions now have until 25 March 2022 to obtain the API functional certification allowing them to share information beyond traditional banking products and services. SUSEP has also released guidelines to implement an Open Insurance framework by December 2022.

Outside Brazil, Colombia URF has also published a draft decree on Open Finance, paving the way for a voluntary, market-driven framework.

Nigeria and South Africa lead open banking regulation in Africa, with the Open Finance Nigeria framework and South Africa’s recently introduced Protection of Personal Information Act. South Africa is also currently in the process of a public consultation on an open finance regulatory framework.

The first half of 2022 will see regulation discussions move to data sharing

In 2022, we’ll see several Asian Pacific countries move forward with their open economy agendas:

- Australia is rolling out consumer data rights to the energy sector - a trend likely to rapidly emerge globally.

- New Zealand is looking to establish a Consumer Data Right framework similar to Australia, with a bill to be introduced to Parliament in late 2022.

- Indonesia is rolling out the second launch of their instant payment system BI-FAST, and are working to introduce Open API Standards.

- The Philippines is implementing an Open Finance framework with a tiered approach.

Europe and the UK are also formalising and regulating the environment for data sharing in the broader financial sector as well as across other sectors.

In the coming months, regulatory development in Latin America will continue to be driven by activities in Brazil, Colombia, and Mexico. Regulators in these areas are expected to continue introducing specific guidelines for the full implementation of local frameworks before the end of 2022.

As for North America, we are excited to see the next steps from US and Canadian regulators as they make further progress toward formalising the open finance environment with several ongoing public consultations.

Sub-Saharan Africa has also made initial steps to achieve open banking by 2025. The latest example is Tanzania, which is looking to introduce an instant payment platform TIPS after successful pilots since June 2021.

Open banking platforms continue to climb

By the end of Q4 2021, we’re tracking 1,537 open banking API platforms globally (up from 559 as of Q4 2020), with 5,133 API products made available (up from 3,496 in Q4 2020).

With 1,153 platforms opening 2,451 APIs to third party providers at the end of Q4 2021, Europe remains the leader in banking platforms created and API products built. The 204% regional growth is largely driven by our tracking more cooperatives and savings banks in Germany, and France having now published their API platforms. We’ve found that while most smaller regional European banks offer PSD2 APIs, it is the larger multinational banking entities that are increasingly focusing on expanding APIs.

More banking platforms have been created in the UK than in the US & Canada (49 versus 30 in Q4 2021), however, the US & Canada offer more API products than the UK (296 versus 253). In the US, 50% of the banking platforms we track are investment banks focused on creating enterprise and business services.

Elsewhere, new regulatory frameworks in some key countries continue to drive steady growth in open banking platforms:

- In the Asia Pacific region, open banking platforms grew 139%, rising to 184 platforms in Q4 2021 largely due to continued deployment in Australia under the CDR framework.

- API platforms surged 147% to 47 platforms in Latin America as participant banks in Brazil progress with their open finance implementations, and incumbents in Mexico begin to share product and services information.

- Similarly, the Middle East and Africa saw a 65% annual growth to 71 open banking platforms in Q4 2021, thanks to activities in Nigeria.

Open banking API product innovation moves beyond compliance

Bank API Products by Category and Region

Q4 2021 (N = 5,133)

Annual growth of API products

Q4 2021

Methodology: Platformable tracks all banks globally and tallies those that have established an open API platform. We then review how many API products are made available by each bank and tally them according to category, and measure other API characteristics such as standards and specifications used, developer experience strategies employed, and business model/monetisation approaches. We review each bank at least once every three months.

Globally, API products rose 47% above their Q4 2020 levels. The biggest increase in API product growth emerged from Latin America (178% annual increase), the US (164%), the UK (122%) and Europe (82%). While we note that open banking API products declined 2% in Asia Pacific, this is largely due to banks shifting from granular, micro-services like APIs to bundled APIs with more functionalities in use-case oriented collections.

Outside the small market observed in Eastern Europe and Russia, mandated APIs (payments, account information, and product information) still account for the majority of open banking APIs product availability in Q4 2021. This majority suggests open banking API product innovation accounts for around 20-40% of the offerings. Identity, trading, and credit services are key areas in most regions, though the US has expanded rapidly on data product APIs. Additions of note in Q4 2021 are Commerzbank’s mortgage widget and Natwest Group’s identity functionalities.

Account and payment APIs made up 49% of total APIs produced in the US & Canada in Q4 2021, reflecting the US’s investment and commercial-led product offerings as well as BaaS models, where banks encourage large enterprises to offer financial services underwritten by the bank to their own customers.

Despite the move from granular to API use case collections in the Asia Pacific region, the share of mandated APIs in the region remained consistent at 57% of all APIs. In the Middle East & Africa, 61% of total APIs were mandated banking products (payments and account information), with trading and identity products accounting for 18% of the innovative API products being created.

Interested in learning more about worldwide open banking/open finance regulatory trends? Sign up for our quarterly Open Banking/Open Finance State of the Market Reports.