How API hype vs API reality plays out in open health, open banking, and open sustainability: Weeknotes #3, January 22 2022

I’m a big believer in open ecosystems and the potential of APIs. However, I do have concerns that APIs can cause brush fires that end up out of control. One of the benefits of APIs is that they enable faster product development by letting developers and businesses build with reusable, composable digital functionalities like lego blocks that can be connected together.

The consequences of product development velocity from APIs

But this velocity advantage means that negative impacts can also spread faster and further. For example, I believe some of the damage we see from machine learning can be traced back to APIs: it is not just that the datasets are biased, which means the machine learning and algorithms are skewed because of the data being ingested, it is also that the use of the algorithms that are based on those biased datasets are integrated via APIs, and used to build more products, at greater scale, and distributed faster and further.

This week, on the same day that I was speaking at a Netherlands event on the potential of using electronic health record data via APIs to improve health outcomes, studies were being published in the US that showed that Black patients had 2.5 times greater probability that their doctors had recorded negative descriptors about them in their electronic healthcare records (EHR). If EHR data was made available via APIs (and with patient consent, and the participation of patient representative groups in what that data is used for), whose responsibility would it be to check that the EHR data was not biased in some way before it was being ingested and integrated? API practitioners might say this isn’t an API issue. Data management practitioners might say the dataset was checked for quality and use of data standards, but that bias isn’t part of their data processing and analysis.

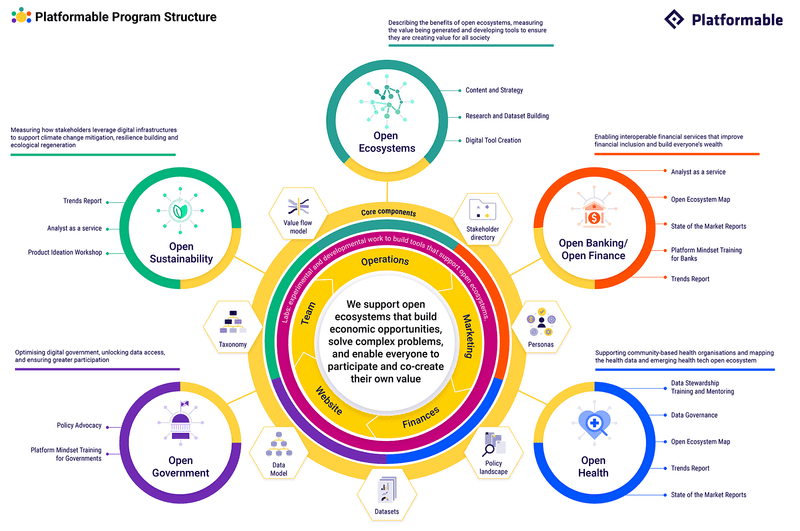

We have models at Platformable that we use to help businesses, community agencies, networks, and governments to think through the potential negative impacts of APIs. Often it is not a case of needing to shut an API idea down, but instead to acknowledge these impact risks and reduce their potential, as well as monitor them during production so that unintended impacts are not being created. For example, API practitioners could ensure that before connecting exposing algorithms for use via API, they could ensure an AI ethics review had been conducted and that the algorithm met algorithmic transparency standards. (The New Stack journalist Jennifer Riggins interviewed me recently about how inequality might be accidentally embedded in government APIs, but the same is true for industry and commercial APIs as well.)

Because I’m a big believer in open ecosystems and the potential of APIs, I feel I have a greater responsibility to also discuss these potential consequences. That’s why at Platformable, we take a step back to first model how value flows in open ecosystems, and then we can identify what datasets will help us measure how that value is distributed.

Are open banking ecosystems benefiting everyone?

This week we launched our latest Open Banking and Open Finance Trends Report which shares the data we are collecting on who benefits from the emerging global open banking infrastructure. I still believe that open banking can redress the market imbalances and underbanked/unbanked marginalisation that was built up as part of the system under the governance of traditional banking oligopolies, and I think fintech can play a huge role in disrupting those inequalities. I also think that open banking and open finance is quickly becoming the world’s global financial services digital infrastructure, which means that we need to carefully monitor who gets to participate as it expands, in case it ends up replicating those previous systems instead of enabling greater consumer choice, financial health, co-creation and participation. To date, most regulators that introduced open banking systems do not have adequate reporting mechanisms to describe whether the implementation of open banking is achieving its goals of generating greater opportunities for all stakeholders (Brazil is the only exception to this: while their data reporting could be improved, it is much more transparent and well thought out than any other regulator's efforts).

Innovation opportunities from open banking APIs

Our trends reports help clarify where open banking is generating benefits (and for whom). They also point to industry examples of innovation that others can learn from. This edition, we share examples from Commerzbank, BCI Chile, DBS Indonesia, NBM Tanzania, Nordigen, Quanto, Pinwheel, and FinScore.

But overall, our findings point to the limited level of product innovation and targeted solutions being built from open banking APIs to date.

We track 1537 banking platforms globally:

But we track only 1943 API-enabled fintech that are building with open banking APIs or are providing or using fintech platform APIs (beyond just using a payment gateway at their checkout):

One reason we believe this is the case is that new solutions are not being created with a human-centred design approach. The lack of fintech that supports the needs of migrants is one example.

The global remittances and payments infrastructure was predominantly built to meet the needs of migrants sending money internationally. In 2019, $7.3 Billion was transferred internationally via mobile money accounts. You could argue that the global remittances market, enabling major payment gateways to create profitable global digital businesses and API platforms, was built by charging migrants when they sent money to relatives, family, and contacts in their country of heritage. But apart from one open banking fintech product that targets (white) UK migrants living in Spain, we have not seen any other fintech that is specifically looking at the other financial needs of this target market segment, despite the clear proof that they are a viable customer segment to pursue with targeted products. It is that lack of thinking that is holding back the potential for open banking, at present.

How will we measure the potential impact of green fintech?

We are also seeing this mismatch between the potential of open ecosystems and the reality of what tech is offering emerging in our open sustainability research. We will be sharing our findings in mid-February. At present, we are determining how to catalogue sustainable products that rely on offsets as the predominant means to mitigate climate impacts.

Our concern, as described by researcher Fraser Stewart in the tweet below, is that new green fintech products like carbon calculators might simply allow a feature where, after calculating the carbon footprint of a consumer based on their bank account transaction data, they then offer a feature that allows users to make a contribution that offsets their carbon footprint through investment in clean energy, tree planting, or other activities.

We are looking at how our open sustainability taxonomy and data models can describe current activities and the growth of API-enabled products focused on sustainability while avoiding overselling those products that may not have a meaningful impact.

Here’s what the Platformable team has been working on this week:

Open Ecosystems

- Continued building a database of privacy technology tools and providers

- Commenced work on a database on API security technologies and tools to be launched at the API Secure conference on April 6 & 7

- RSVPed to attend The Rise of Privacy Tech launch event next week. See you there?

- Mapped out new content strategy work with several of our clients

Open Banking/Open Finance

- We launched our Open Banking/Open Finance Trends Report! Have a read and let us know what you think

- Continued working with a client on our API product monetization workshop and tool

Open Government

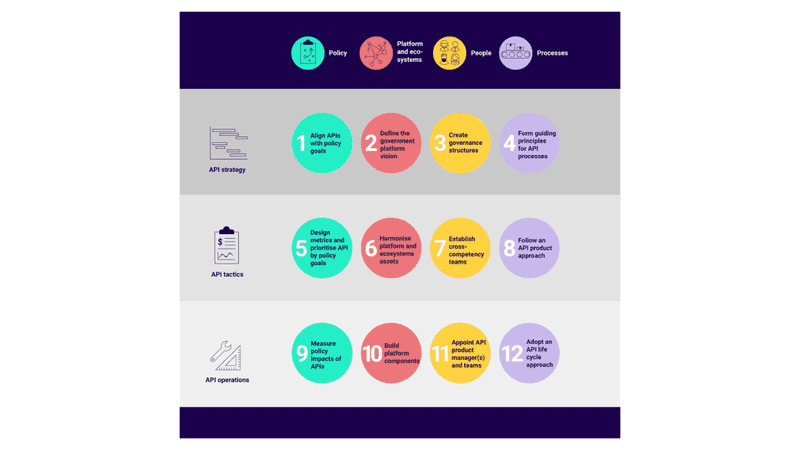

- Continued work with clients on API strategy and API management technical architecture design

- Started coding all feedback from our industry interviews conducted for a client’s API strategy assessment project. We are using Happyscribe to create transcripts from our zoom interviews and Dovetail to tag interview comments into topic categories

Open Health

- Presented at a secondary use of health data policy event hosted by The Confederation of Netherlands Industry and Employers (VNO-NCW), sharing research Mark Boyd collaborated on with the Open Data Institute’s team

- Continued work on data governance projects for our community health organisation clients

- Continued to add to our open health ecosystem database

- Worked with a client to support them recruit a Data Analyst with data governance and health equity skills

Open Sustainability

- Prepared to speak at an event focused on the potential of using open banking APIs for sustainability, being hosted by Axway on 8 February:

- Completed the next stage of our dataset collection

- Continued research for our trends report looking at how open banking and open finance APIs can support sustainability efforts (to be launched on 15 February)

Business Development

- Held internal meetings on marketing strategies and data product ideation

- Updated our website to include our recent product releases

- Celebrated a team member’s birthday

- Recommitted to sending out a monthly newsletter to our subscribers, with our continued promise not to email more than once a month

- Met with potential partners to discuss how to work together

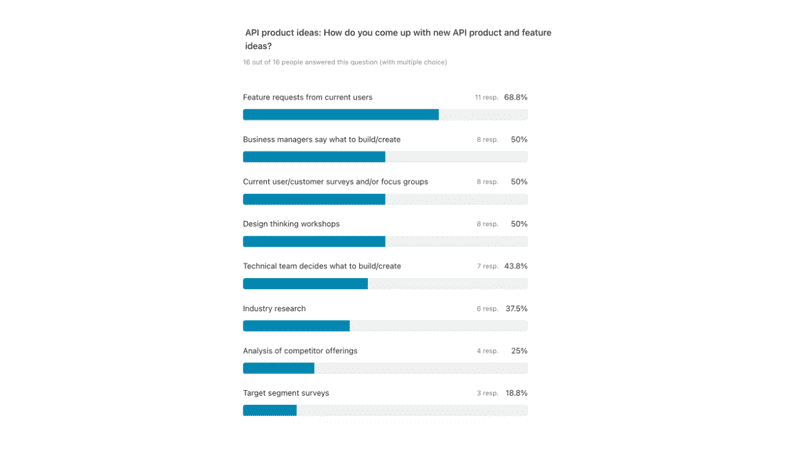

- Launched our Survey of the Month Club…

Announcing our Survey of the Month Club!

At Platformable, we regularly collect data on industry perspectives and trends, and we want to start extending that to gaining insights from our readers and wider networks. We have launched a Survey of the Month Club where you can answer a few simple questions each month to help us collect data points. Each month we will give away a 200 Euro voucher to one survey respondent. This month, our voucher can be used on either Back Market (for refurbished, high quality tech products), Wordery or Bookshop.org (for business and API books). This month’s survey will take 5 minutes, and is suited to business and product managers overseeing API strategies, API architects and developers, and anyone else that works with APIs in at least part of their work. We also collect demographic data to ensure our survey respondent population is diverse in terms of role, type of organisation you work in, race and ethnicity, gender, and sexual orientation. We will be publishing aggregated, anonymised survey results in future Weeknotes and in our other content.

You can fill in the survey right now and go into the prize draw raffle: