Open Banking Trends Q2 2020: Banks

9 min read

Share this article

Last updated: August 4, 2020

Open Banking Platforms Q2 2020

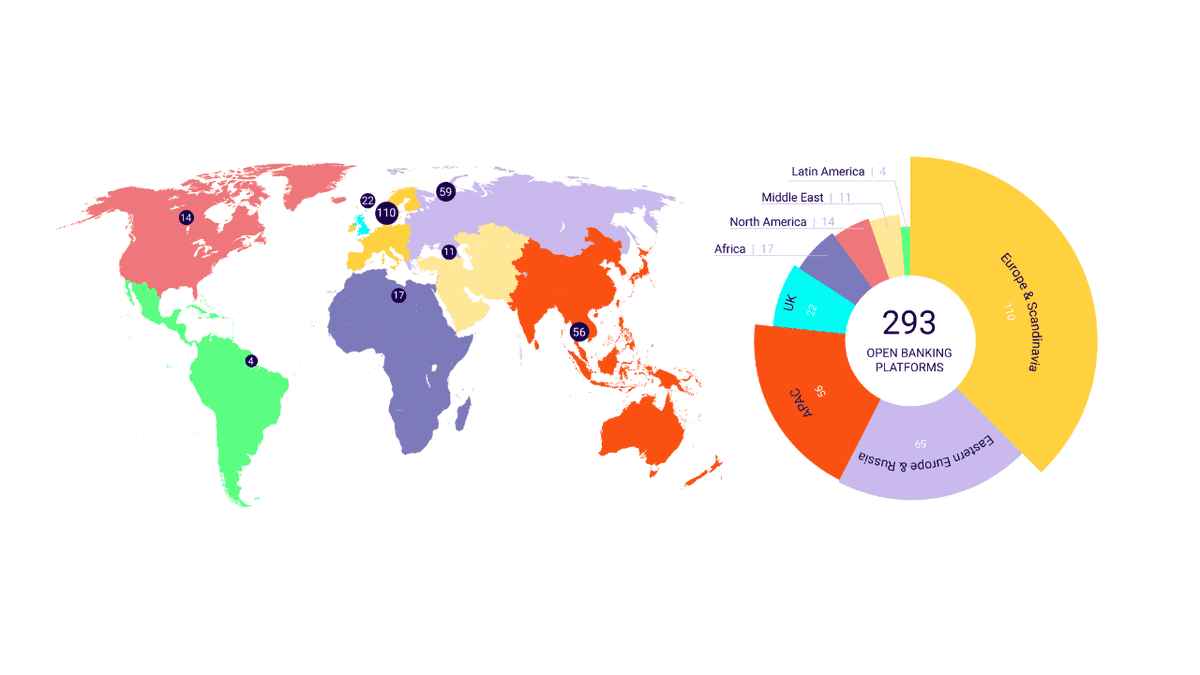

Open banking platforms grew rapidly between Q1 and Q2. This was driven by European banks catching up with regulatory requirements that commenced in September 2019 for banks to release mechanisms (APIs) to allow payments and accounts to be exposed to accredited third party providers. Regulation in other areas, notably in New Zealand, also added to the list of banks with API platforms.

Open Banking Platforms by Region, Q2 2020 (N=293)

Open banking continues to expand globally, with all regions having banks moving to open APIs. As previously noted, 72% of the top 50 banks ranked by market cap have API platforms. This quarter, we observed all types of banks opening APIs: retail, commercial, agricultural and private banks, for example, were all moving towards platform models. Sometimes quickly, sometimes slowly.

Open Banking API products, Q2 2020 (N=2029)

Accounts (575, or 28% of all products) and payments (541, or 27% of all) API products remain the most common internationally. APIs cataloguing bank product details (including ATM locations) are also prominent (accounting for 12% of all API products globally), especially in countries like UK and Australia where open banking regulations mandate that banks provide APIs for this use case. Identity APIs (7.6% of all API products) and credit scoring APIs (5% of all API products) are the next two most popular categories.

The low numbers of products available for non accounts and payments categories partly indicate the lack of current bank creativity in thinking about future financial products and the potential of working with fintech partners. Under some regulations, banks are not able to charge for account and payment APIs, they are obligated to make them frictionless to spur the fintech market. But it is with value-added APIs that banks can begin to monetize their offerings. The fairly low number of offerings in part reflects the work banks have had to undertake to date to meet their obligations, which has been their focus, but it is still somewhat disappointing not to see more innovation. There is still plenty of opportunity for banks in all regions to climb quickly to a leadership position by leveraging open APIs and supporting partners to build new products and services.

Open Banking pricing and business models, Q2 2020

One of the expected benefits for banks is that they will be able to create new business models which extend their value chain by working with partners and API consumers. For example, banks that have not been able to reach particular consumer market segments can work with partners who are trusted by those segments.

Permata Bank in Indonesia were able to do this to reach new target groups using crowdfunding and investing, for example. The fintech partners offering these services needed their customers to have bank accounts, thus increasing account creation at Permata Bank, creating an annual growth rate of 68% via their APIs.

Other banks with innovative business models and partnership models include:

- HSBC Hong Kong has partnered with the Hong Kong Science and Technology Parks Corporation to identify potential fintechs who they can work with to build products for existing and new customers. Under the new API EcoBooster program, the HSBC digital team offers mentoring services to the successful fintech applying to the program. In the press release announcing the new initiative, Diana Cesar, Chief Executive, Hong Kong, HSBC, acknowledged the need for banks to take a more partner-oriented approach in order to reach customers: “Open banking is playing a pivotal role in driving innovation in financial services. We look forward to seeing the creation of pioneering API solutions that make banking more accessible for both individuals and businesses.”

- Like Erste Group in Eastern Europe, Commerzbank in Germany has a dual track API program. On one track they offer their "PSD2 APIs" while on their "premium partnership track" (Erste calls theirs 'George Labs') they seek out fintech partners with which they can build ongoing relationships. For premium partners, they provide consulting and coaching, work collaboratively on product design thinking, and link partners with others in their ecosystem. Interestingly, Commerzbank are looking for partners that offer APIs that the bank can consume, as well as fintech and other partners who want to use the bank's APIs.

- Solaris Bank has taken an alternative route. When open banking first commenced, Platformable discussed the various paths that banks could take, and warned that without a platform mindset, a bank could be relegated to being simply the infrastructure or rails beneath fintech, which holds the customer relationship. Solaris has turned that risk on its head and made it a compelling value proposition. They focus their API strategy on helping enterprises and tech companies to offer full banking services to their customer segment: everything from verifying identity, creating accounts, branded credit cards, and so on. The white-labeled banking services are already in use by their German company partners (that is, API consumers): Kontist, Penta, Tomorrow and Insha.

- ABN AMRO was one of the first banks to release APIs. Last year, they were still experimenting with business models, but this year, they have also released a clear pricing model for their Tikkie API. After the update of their developer portal this quarter to increase engagement with API consumer partners, they now show the value proposition for API consumers: that payments processing is more likely to be completed in the shopping cart and that payments are processed to business bank accounts faster. They also have a clear transaction pricing model, similar to that used for other payment processing APIs.

Other key opportunities/benefits for banks

We believe that banks will increasingly turn to their API teams to help them build APIs not just for exposure to partners and as part of regulatory requirements, but also for internal use. Some leadership banks that already had strong open API programs have been looking to their API teams to support them in shifting internal infrastructure towards digital delivery.

In an interview in Q2 2020 with Crowdfund Insider and Cambridge Centre for Alternative Finance, Plaid's Policy Lead, John Pitts said:

"That [digital] transformation was already occurring before the onset of the pandemic, but it has accelerated change exponentially and practically overnight. Since the end of March, digital banking apps increased revenues by 17% and virtual banking apps in the US experienced a 60% increase in downloads and installations as consumers weren’t able to visit physical locations due to lockdowns."

This acceleration of digital transformation and need to work with API teams to build new banking technical infrastructure will come at the expense of a bank teller workforce and some traditional product lines. Banks have already indicated downsizing goals in terms of branch staff and infrastructure. Pitts also highlighted a UK study that found "1 in 4 customers aged 18-34 plan to use bank branches less or stop visiting physical banks overall after the pandemic ends".

We do not yet see banks realising, in the age of COVID-19, that APIs can play a part in helping banks address growing customer loan defaults. In some jurisdictions, banks are required by law to allow customers to freeze their loans due to COVID-19 and many customers have chosen to do so, including those who continue in employment. But for banks with business customers who have seen a downturn in sales or patronage, and with household customers that have members that are in furlough or now unemployed, loan defaults are a greater risk (in U.S, Europe and Asia). Banks could work with fintech partners to recalculate credit risks, extend loan arrangements, support customers to stretch cashflows, or "park" loans in other models rather than continue to see the uptick in loan defaults. 'Loan defaults' is often a key performance indicator reported to investors by banks. Mechanisms to work with partners to reduce the risks of loans would build out their ecosystem and help banks maintain their customers and incomes during this public health (and economic) crisis.