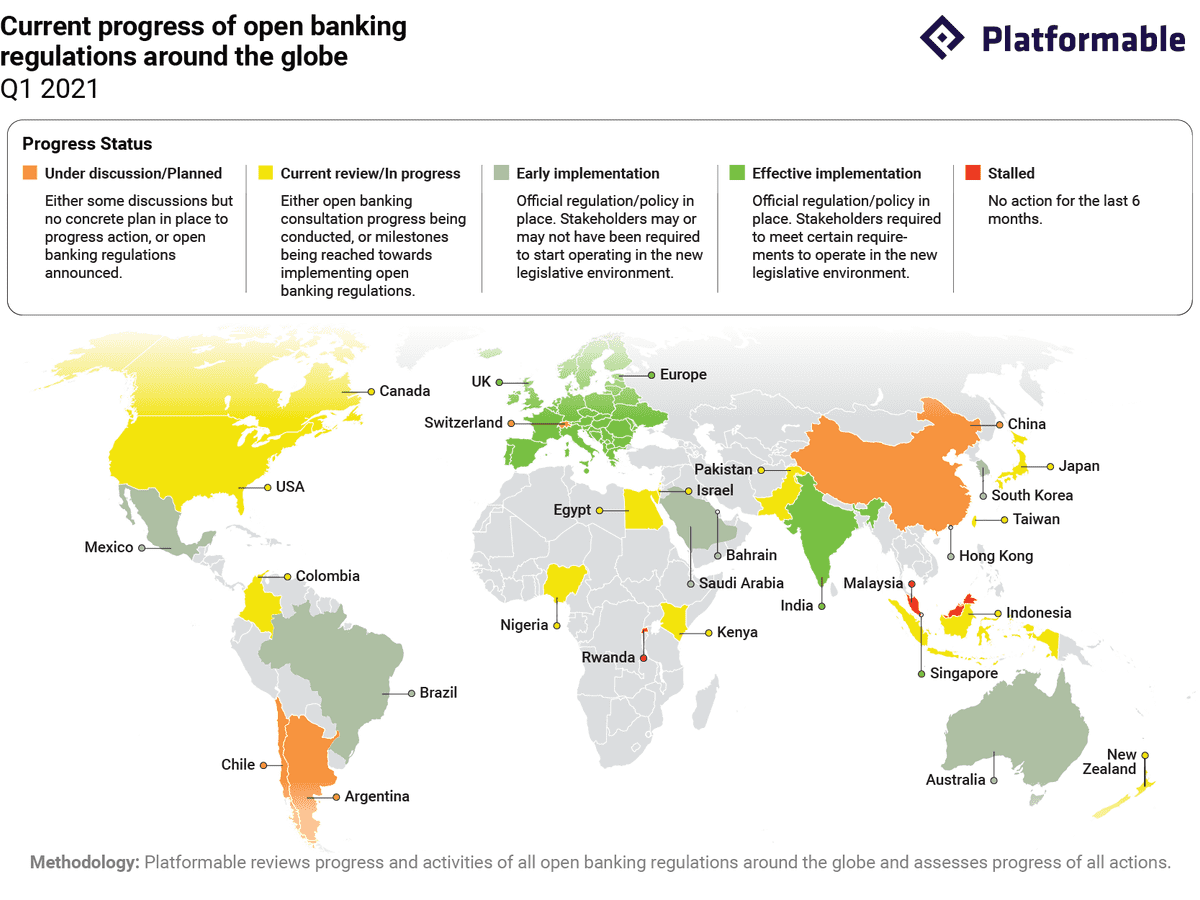

Q2 2021 Open Banking Trends: Regulations Shift to Open Frameworks in Finance, Data Sharing Across the Globe

4 min read

Regulations are one of the key enablers in an open banking ecosystem. Regulations can allow new market entrants, safeguard citizen finances, and encourage financial inclusion. Though specific open banking and open finance regulatory goals differ across countries, may specifically aim to enable interoperability, enhance competition, with several noting that by doing so, there are expectations that financial health and wellbeing of individuals and businesses will improve. Platformable's Q2 2021 Open Banking/Open Finance State of the Market Report describes current timelines and progress on the adoption of regulations in each country.

As digital economies expand, regulatory focus shifts to open finance and data sharing

Today's current regulatory environment is expanding its focus across the globe:

- Europe and the UK, long seen as open banking pioneers, are now looking to widen their regulatory framework to open finance. Proposals put forward by recent public consultations are currently under review by regulators.

- Elsewhere, open banking regulations are emerging in Australia, Bahrain, Brazil, Hong Kong, India, Mexico, Nigeria, Saudi Arabia, Singapore, and South Korea. More recently, Indonesia, the Philippines, and the UAE have also introduced regulations. Some jurisdictions have chosen to focus directly on open finance (e.g. Brazil, Nigeria, Philippines) or wider cross-sector data sharing (Australia). Others take a more tentative approach, starting with bank product information and payment services (Indonesia, Mexico, UAE).

- The US, Canada, Colombia, and Russia are moving forward with open banking public consultation process in Q2 2021. The US, which has traditionally relied on industry-led standards, may soon welcome a more mandated framework following the recent public consultation on proposed rule-making for consumer access to financial records.

- The Retail Payments Activities Act has been introduced in Canada to encourage more fintech participation. The Canadian government is considering implementing a hybrid framework and is currently in the second phase of its review on open banking.

Where are open banking regulations heading next?

Full implementation of open banking is set for several Asian Pacific countries in 2022. New Zealand is already looking to establish a Consumer Data Right framework similar to that of Australia.

Indonesia plans to fully launch its instant payment system BI-FAST and Open API Standards, and the Philippines will implement its Open Finance framework with a tiered approach.

Meanwhile, UK and European regulators have mapped out their next steps to create an open finance regulatory system in the wider context of UK Smart Data initiatives and European Commission Digital Finance Strategy. The UK Money and Pensions Service will also review stakeholder inputs on a pensions dashboards ecosystem by 2024, and the European Insurance and Occupational Pensions Authority is receiving feedback on pension tracking services and pension dashboards by September 8th.

In Latin America, Brazil continues to roll out its open banking plans despite an expected delay in the full implementation. We’re looking forward to their next steps following a recent public consultation on open insurance by the Superintendence of Private Insurance (SUSEP). Colombia is another country to watch as they progress toward a voluntary framework later this year.

As for North America, we’re awaiting further news following the US Consumer Financial Protection Bureau’s recently completed Advance Notice of Proposed Rule-making for Consumer Access to Financial Records and the results of Canada’s ongoing government review of open banking, currently in its second phase.

Interested in learning more about worldwide open banking/open finance regulatory trends? Keep up with our Open Banking/Open Finance trends reports.