Measuring Value in the Open Banking Ecosystem: 1. The Model

13 min read

Open banking aims to create greater value for all stakeholders in the finance ecosystem. But does it really? Are our institutions even measuring whether the benefits of an interconnected, integrated banking and financial services ecosystem is actually an improvement over the traditional monopolised (some would say oligarchical) banking system?

At Platformable, we have:

- Defined the open banking value flow. Drawing on industry and academic research, as well as our own datasets and analytics techniques, we have documented how value flows to various stakeholders in an open banking ecosystem.

- Identified primary and supplementary metrics for ongoing measurement. We have identified each node in the ecosystem. We have defined a primary indicator/metric and secondary data points for each of these ecosystem nodes to measure their impact on generating and distributing value. We are also testing calculating scores for key components of the open banking ecosystem so that we can create scorecards and rankings of where open banking maturity is progressing.

- Created a regular data collection system. We now have processes in place to continually collect and monitor how value flows in the global open banking ecosystem.

- Analysed and shared data in regular formats. We are now in the process of creating analytics tools and products to share the data we are collecting. To start, we have created a new quarterly trends report product, which includes a quarterly data trends summary and monthly deep dives into industry practices (focusing on business models, use cases, and technical architectures).

This post is the first in a series describing our open banking ecosystem model. First we describe our open banking value flow model. In future posts, we will then share our data model and core metrics behind each node in our ecosystem map. We also plan to release our methodology as a data dictionary and will open source this to invite contributions. Subscribers of our trends packages gain access to the datasets we collect, so we will also release future posts on how to use the data and value flow model to analyse the industry and identify gaps, opportunities and potential partnerships.

Just a quick note: Our previous series looked at our worldview on how open ecosystems operate and why it is important to measure them. It defines some of the concepts we will continue to use in this series.

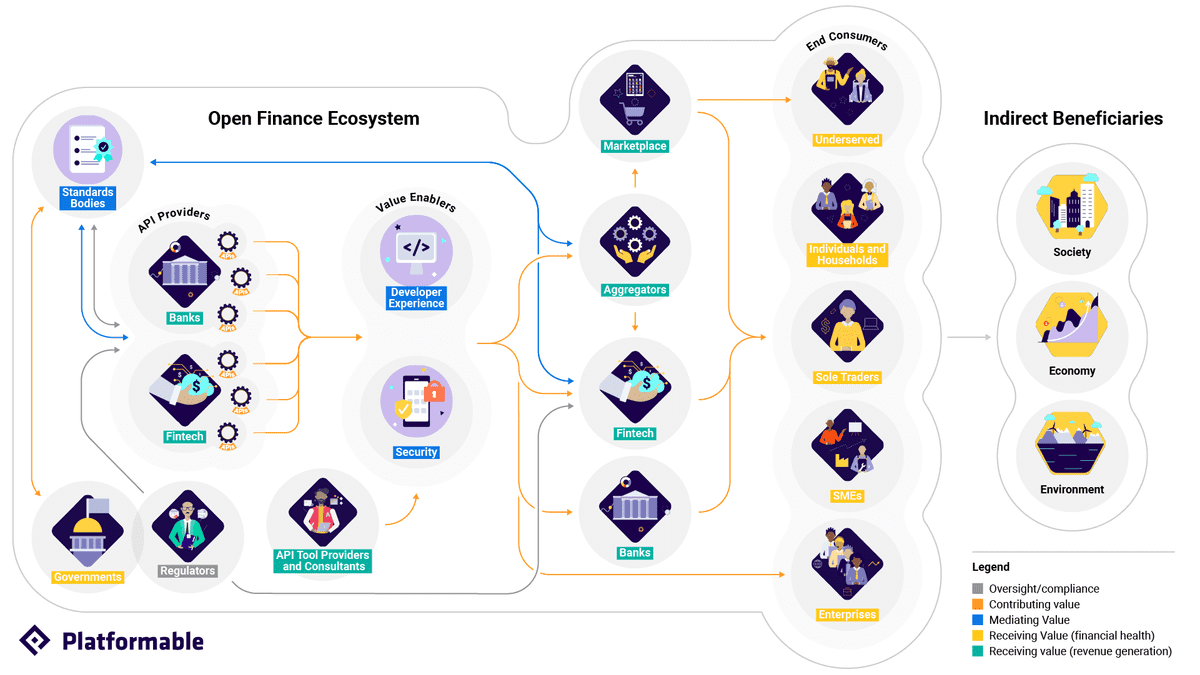

Here’s what our open banking ecosystem value model looks like:

The rest of this post will describe it in detail, but first we want to clarify our definition of open banking.

Definitions of open banking

Our definition has been informed by key industry experts and thinkers:

- Faith Reynolds, Independent Consumer Finance Expert, states: “Open Banking – open finance – must focus on creating, deploying and facilitating the movement of money to help us achieve our goals as individuals, communities and society as a whole.”

- Open Banking Nigeria’s Simon Aderinlola and Adedeji Olowe define Open Banking as:“Open banking refers to how financial institutions and third-party providers (FinTechs, InsurTechs, Lifestyle service providers, Retail companies, Telcos, Energy companies etc.) leverage open Application Programming Interfaces (APIs) to share data in a standard format to drive open, transparent, innovative and competitive banking services. Innovative traditional banks, FinTechs, agile neobanks, and digital disruptors are shaking up traditional banking rules, taking advantage of Open Banking, to spark cross-industry collaboration and creation of exciting new channels for customers.”

- The US industry-based Financial Data Exchange describes the importance of creating integrated ecosystems for open banking: “Further coordination among all of the stakeholders in [data sharing] – financial institutions, data aggregators, fintech providers, regulators and consumers themselves – will be critical to achieving a secure, inclusive and innovative financial data-sharing ecosystem that supports consumer financial health.” (FDX white paper)

- Eyal Sivan, Mr Open Banking, and Head of Open Banking at Axway, says that, at its core, “open banking is about the development of a standard, common way for banks and other companies to securely share your financial data.”

- Open Banking researcher at University of Manchester, Markos Zachariadis, defines an open banking framework as: “a secure and standardized technology which, when coupled with rules and procedures, allows consumers to safely create, share, or amend their digital records (e.g. transaction data, payment initiation, etc.) with authorised third parties offering products and services.”

Ecosystem Components: Key stakeholders

At Platformable, we have identified 5 key stakeholders in open banking ecosystems:

- Banks themselves: Banks should be able to build new digital business models that drive new revenue and cost efficiencies.

- Fintech: Fintech should be able to enter the market and compete to become viable businesses.

- Consumers: Individuals/households and businesses (sole traders/microenterprises, SMEs, and larger enterprises) should gain access to new financial services and products that help them manage and build their financial wealth.

- The underserved: Previously unbanked and underbanked individuals/households and businesses who may have been locked out of traditional banking should be able to gain access to financial services and build their financial health.

- The API industry: The API industry should be able to grow and mature, with API tools providers becoming more viable, and the industry’s tooling and methodologies maturing as large bank enterprises contribute their experience to improving API infrastructures.

For each of these stakeholders we have created a definition and referenced a taxonomy that defines core stakeholder characteristics and sub-groupings.

We have also identified three indirect beneficiaries that are receiving (or should receive) value from open banking and open finance. These are modeled on triple bottom line economic reporting, Environmental, Social, and Corporate Governance models, and other corporate and community sustainability reporting approaches. Open banking and open finance open ecosystems should indirectly benefit:

- Society: By generating new tax revenue from market participants, and creating more dynamic engagements between citizens and the services they use with less friction.

- Local economies: Open ecosystems should overcome the extractive value risks of larger platform models in which local economies are mined for data but receive no benefits. Open ecosystems should enable new employment, local taxes and other revenue generation, and enable participants to be rewarded for their participation and data sharing.

- Environment: Open banking and open finance ecosystems should be sustainable and use limited resources within responsible limits.

Ecosystem Components: Enablers

At Platformable, we have identified 4 key enablers that enable value to be distributed within open ecosystems:

- Regulation: Regulations ensure that the open banking and open ecosystem can enhance competition, safeguard citizen finances, and encourage financial inclusion. Specific regulatory goals may differ by each jurisdiction, but the goals are generally to enable interoperability, enhance competition, and encourage financial inclusion.

- Standards: Standards can help with the velocity of new product development, encourage scalability of products across geographic markets, and are recognised as an essential component of a well-functioning ecosystem

- Developer Experience: The ease with which developers can use and integrate open banking and open finance APIs will either speed up or slow down the creation of new financial services and products.

- Security: Strong security enables trust by consumers within an open banking system and gives confidence to all stakeholders, as well as protects and gives recourse to all stakeholders who are participating in the economic ecosystem.

Ecosystem Components: Value Flow

We have also mapped how value flows in an open banking ecosystem. We believe when an open ecosystem functions effectively, stakeholders can work together to co-create, collaborate, compete, complement, or coordinate with each other. But it is only after it is understood how value flows that those kinds of relationship activities can be planned. We see that there are four ways value flows:

- Contributing value: In an open ecosystem, we are measuring how each element contributes value, so this is our core pathway through the open ecosystem, with each element contributing value to the next element.

- Mediating value: In an open ecosystem, we believe standards, developer experience, and security help mediate value. That is, the value that flows through the ecosystem will increase if there is a high level of developer experience (for example, when developers easily understand and can use the APIs), and if APIs are secure and robust. Where these are weak, value can still flow through an ecosystem, but it will be at a trickle, rather than as a running stream.

- Receiving value (financial health): The whole point of an open banking ecosystem is that stakeholders benefit. End consumers including individuals, the underserved and businesses should all have greater access to products and services built with open banking APIs that widen their choices, and help them build their financial health (through savings, better loans, faster transactions, etc).

- Receiving value (revenue generation): Certain stakeholders in the open banking ecosystem should also generate revenue value: Either directly or indirectly. Stakeholders may be able to charge for their value-adding contribution in the ecosystem, or they may be able to expand their customer base which lets them generate revenue in other ways, not using the banking APIs.

The Open Banking Manifesto

Our value model has been inspired in part by the Open Banking Manifesto, as documented by Faith Reynolds and Mark Chidley in Consumer Priorities for Open Banking:

- Open banking should be a force for good which promotes financial inclusion and widens access to more useful, affordable and understandable financial services for everyone.

- Services should meet people’s positive expectations, be upfront about how they’re paid for and how they use personal data. They should be sold and delivered in a way which respects people’s identity, their data and their right to make the most of their money and live the lives they want to.

- Open banking should genuinely equip people with real power to control access to their account and use of their data. People should be able to stop sharing access to their account easily without facing penalties.

- Open banking should be reliable and as secure as it possibly can be. It should be clear to people with whom they are sharing their data and the legitimacy of those companies. Data breaches and fraud should be rare and exceptional, not the rule.

- People, their identity and their money should be universally safe. People should not bear unfair risk. When things go wrong people should have simple, free, quick access to help and redress.

How Value Flows in the Open Banking Ecosystem

In many cases, governments request regulators to establish open banking systems to widen the access to financial services beyond bank delivery.

Banks then create APIs, often to industry-based standards, to expose financial service functionalities.

How much value these APIs create will depend on how well they are documented, and how secure they are. So developer experience and security are value enablers that can increase how much value is generated from the bank APIs. Low developer experience makes it harder for others to integrate with the APIs and build products and services, and low security means consumers won’t trust the products built with the APIs.

The banking APIs are then used by fintech, aggregators and marketplaces to build products and services. This can happen directly: fintech may take the bank APIs and integrate each one individually into their product, or they may use an API aggregation platform that has already integrated a bunch of bank APIs to make one unified API that can be used by fintech to link to multiple banks at once. Aggregators may also make their unified API available to marketplaces so that ecommerce platforms, subscription services, and payment providers can integrate with multiple banks at once without integrating each bank’s individual APIs into their platform.

Now end users are able to use those fintech products and services that have been built with the open banking APIs:

- Individual and household users may make use of fintech,

- The underserved may be able to access financial services in ways they couldn’t with banks, such as through access to lending or account creation

- Sole traders, freelancers, and small businesses may have access to a greater range of products and services, and

- Enterprises can either use fintech that integrates with their bank accounts or they may even use APIs directly provided from their bank and integrate them into their business workflows.

So end users receive value in terms of greater access to financial services, more seamless ways of doing their financial tasks seamlessly, and hopefully those products also help them save or grow their wealth.

In return, some ecosystem stakeholders generate new income: fintech, aggregators and marketplaces can charge for their products and services, in some countries banks are able to charge directly for use of their APIs, and where they can’t, the fintech may be bringing in a new customer base, so, via open banking relationships, banks can grow their loan book or build relationships with new customers they previously didn’t have access to. API tools providers and consultants can also generate income by offering services to banks and fintech to help them increase the mediating value of security and developer experience.

Finally, when this ecosystem is flowing effectively, there are indirect benefits being generated for everyone: society improves because people and businesses can function more seamlessly, with less time spent on things that can be automated or done digitally. If open banking ecosystems were up and running, they could have been used to more easily facilitate access to COVID-19 relief and support payments, for example. Local economies benefit because fintech can be an employment engine for new staff hires, and because they contribute to the country’s tax base, and the environment can benefit because digital systems allow resources to be used optimally, and because new products and services that help us calculate and address our carbon footprint can be created.

Open Banking/Open Finance Value Flow Model

Open banking is just a subset of the wider open banking/open finance ecosystem, and we are seeing that expand into an approach that is often referred to as “embedded finance”, in which financial and banking services are integrated with other digital value flows so that banking, finance, insurance, any monetary or wealth-related transaction is a seamless part of whatever our primary engagement goal is setting out to do. (I spoke about this idea with BBVA’s API Marketplace just as ‘embedded finance’ was first becoming a term.)

So in fact, the open banking/open finance ecosystem looks more like this:

In this model, fintech API platforms also offer a range of product APIs for which not only other fintech can build, but other banks as well. We are seeing this already: banks are using API account aggregator products to integrate other bank accounts into their branded budgeting apps, and integrating fintech into their own business and retail marketplaces to make those fintech services available to their customers. In some countries, banks began as insurance companies and extended themselves last century by acquiring banking licenses: those providers are now creating insurance product APIs, while those without insurance products are consuming insurance provider APIs to make them available within their product range.

Over the rest of this series, we will dig deeper into the metrics we use for each element of the value flow model. We will describe our data dictionary, including our taxonomies, definitions, metric framework, data collection methodologies, and scoring calculations.

You can also reach out and discuss your thoughts on our model with us, feel free to book a time for a chat with our analyst team.