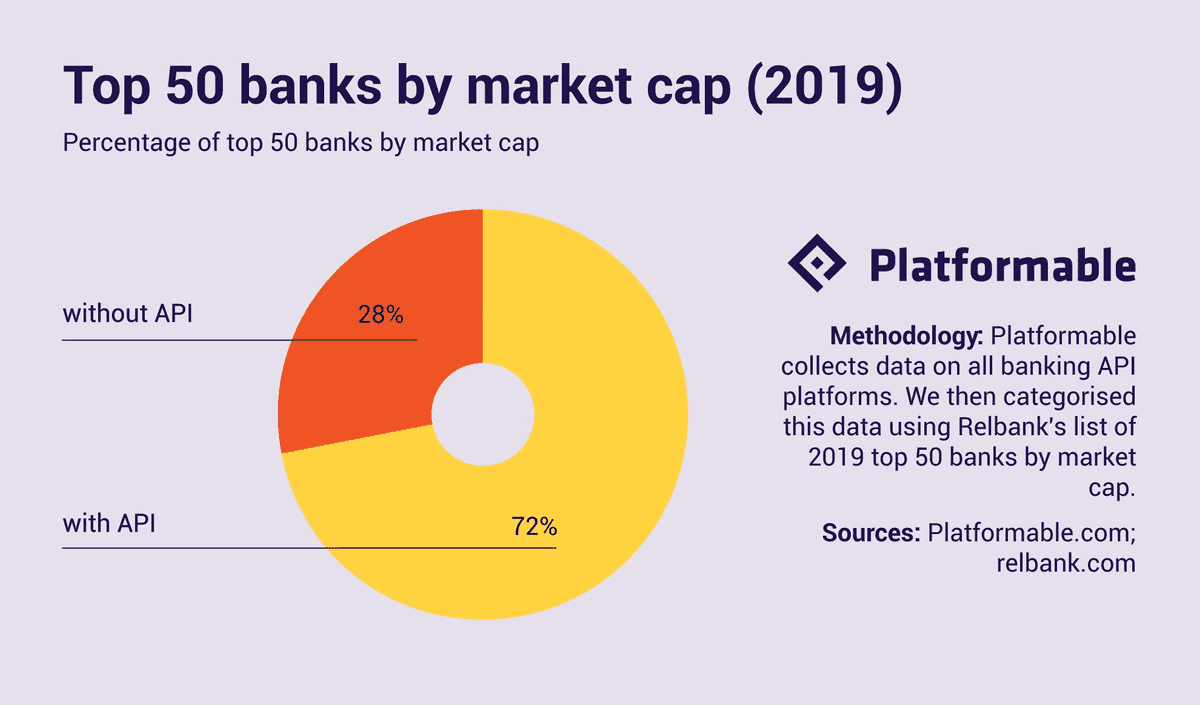

Datapoint: Top 50 banks by market cap with API platforms

3 min read

Last updated: 24 March, 2020.

Market capitalisation (market cap) is a measure to estimate the overall value of a company. The top 50 banks by market capitalisation is a way of measuring the largest banks in the world. Are the world's largest banks moving towards API infrastructure?

Top 50 global banks with or without API platforms

Out of the top 50 ranked banks, 36 have API platforms.

All banks in the top 50 had market caps over 10 billion dollars. (Germany's Deutsche Bank which came in at 50th position has a market cap of $USD15.77 billion in July 2019.) Merrill Edge, an investment company that is part of Bank of America, notes that companies with market caps over $10 billion tend to be more conservative in making business decisions. As they grow and accumulate value, they take less risks in order to maintain their ranking position.

So technically, one would expect these banks to be less aggressive with setting up API platforms. That's clearly not the case. All banks ranked in the top 5 worldwide have API platforms.

For top banks, regulations are not the only driver

If regulations were the key driver, those banks in the top 50 that are located in UK, Europe, Hong Kong, Australia, and Singapore would be the most likely to have API platforms.

While that is the case, there is also plenty of activity in areas without regulatory requirements for open banking as yet. For example, 8 of the 10 U.S. banks ranked in the top 50 by market cap have API platforms.

Opening the data

We are sharing some of the data points we have collected, this spreadsheet shows the name of the bank, their ranking and value, whether they have an API platform, and how many APIs they have released.

Further analysis

This datapoint summary will be further explored in the next Open Banking: State of the Market Report. If you have any specific questions you would like us to answer that analyses Banking APIs by market cap of banks, ask them below, or join our newsletter to get more datapoint summaries like this and an advance copy of the State of the Market report (in May 2020).